OUR BUSINESS

ORGANISATIONAL

OVERVIEW

ABOUT NSSF

The National Social Security Fund (NSSF) is a provident fund mandated by the Government of Uganda through the National Social Security Fund Act, Cap 222 (Laws of Uganda) as amended. The Fund covers all workers in the private sector regardless of the size of the enterprise or the number of employees.The Ministry of Gender, Labour and Social Development and the Ministry of Finance, Planning and Economic Development are jointly charged with the oversight of the Fund. The Fund is also regulated by the Uganda Retirement Benefits Regulatory Authority (URBRA), as applicable, following the enactment of the URBRA Act in 2011.

NSSF @ a glance

Branches

Sub-Branches

Outreach Centres

Dedicated Staff

Registered Members

Registered Employers

Total Contributions UGX

Total Realised Income

Cost of Administration

Total Asset Value UGX

Benefits Paid Out UGX

Benefits Turn Around Time

Our commitment to customer centric excellence

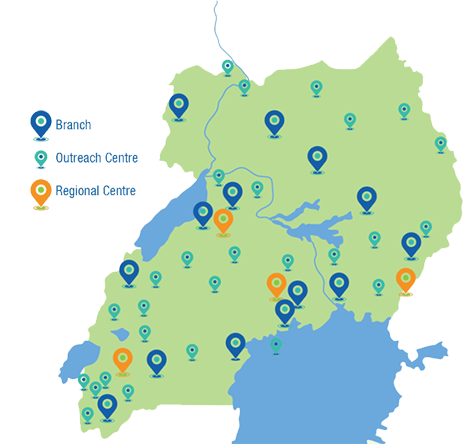

We are the biggest institution in the region with centres in all regions of Uganda manned by competent and energetic teams, availing our members with the very best in social security. We maintain our commitment to innovation in both products and services, adapting to evolving customer saving requirements and consistently seeking avenues to elevate our customer service.

Products and Services

The Fund is a contributory scheme and is funded by contributions from employees and employers. Employees contribute 5% and employers add 10% of the employee’s gross monthly cash emoluments. The Fund also receives voluntary contributions from self-employed persons and top-ups on mandatory contributions.

The Fund invests these funds and provides annual returns in the form of interest to its members but also processes prescribed benefits for qualifying members.