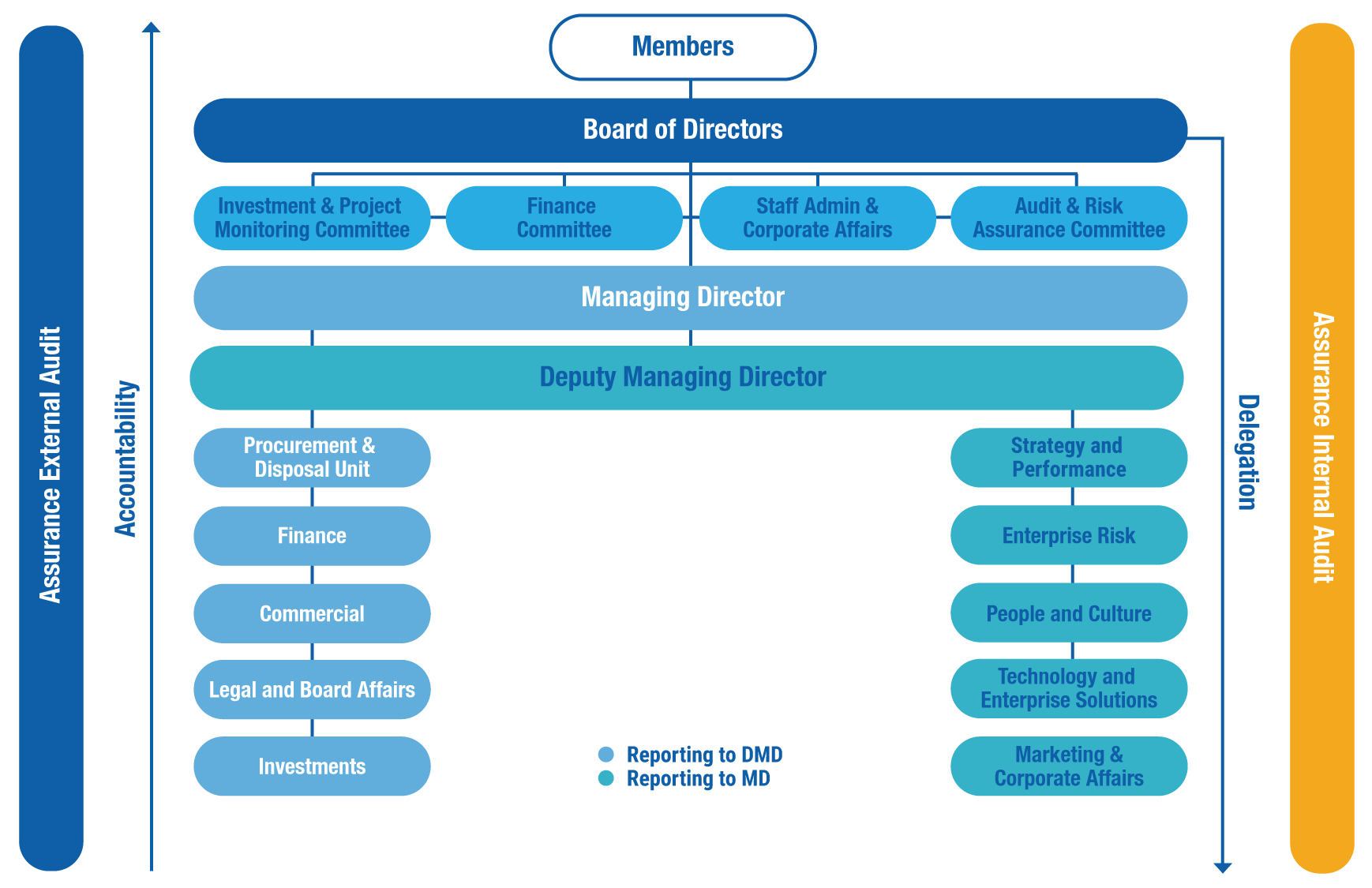

OUR GOVERNANCE

Corporate governance aligned to King IV principles

PRINCIPLE 6: PRIMARY ROLE AND RESPONSIBILITIES OF THE BOARD

King IV principles and our activities

GOVERNING STRUCTURES AND DELEGATION (P6-P10)

Outcomes

Roles and responsibilities of the Board

Responsibilities of the Board which are included in the Board mandate to fulfil the primary governing roles and responsibilities

The Board of Directors are responsible for the Fund’s vision, strategic direction, its values, and governance by providing effective leadership towards:

Role of the Non-executive Directors

The responsibility of the Directors is to exercise their independent judgement in the best interest of the Fund and its members, by:

The Non-Executive Directors meet separately as and when required. During the year of review, they met to discuss the transition of management at the Fund and relevant succession planning.

Board activities in FY 2022-2023

Key

Strategy Implementation

Policy, Charter, Manual Review & Approval

Stakeholder Activity

Corporate Governance

| Jul | Aug | Sep | Oct | Nov | Dec |

|---|---|---|---|---|---|

For period ending 30 June 2022 Finance Committee reviewed and discussed:

|

Extra ordinary SACA to review:

|

Review of the Draft NSSF Audited Financial Accounts FY2021/2022

|

For period ending 30 September 2022: Finance Committee reviewed and discussed:

|

|

|

Board activities in FY 2022-2023

| Jan | Feb | Mar | Apr | May | June |

|---|---|---|---|---|---|

6th extra ordinary Board meeting for FY2022/2023:

|

Joint consultative meeting between the Board and NSSF management:

|

2nd ordinary Board meeting for FY2022/2023:

Review of Board Training/ Conference Reports and recommendations |

No activities undertaken | 2nd special meeting of the Board: Briefs on the prevailing legal claims on Fund properties:

|

No activities undertaken |

The Board action plan for 2023/2024 will cover the following areas: