OUR STRATEGY

STAKEHOLDER ENGAGEMENT

AND VALUE CREATION

Our Regulators and Government

During the Financial Year (FY), the Fund has actively involved its regulators and Government in an ongoing process of collaboration, striving to create sustainable value for our members, stakeholders, and society as a whole.Our reputation depends on and is also influenced by our regulators and government’s perceptions, which in return affects our performance. We therefore have a shared responsibility to engage with these key stakeholders across all aspects of our operations and functions, utilising various communication channels. They play a vital role in our success at every stage in our value chain.

Our regulators include government, Parliament of Uganda, Ministry of Gender, Labour and Social Development (MGLSD), Ministry of Finance, Uganda Retirement Benefits and Regulatory Authority (URBRA), as applicable, Public Procurement and Disposal of Public Assets (PPDA), Solicitor General, Attorney General and Uganda Revenue Authority (URA), Capital Markets Authority (CMA), National Environmental Management Authority (NEMA), Financial Intelligence Authority (FIA) and Bank of Uganda among others. Our engagement with these regulators extended throughout the year, with clear expectations of the intended outcome of the interactions.

The productive two-way engagement with regulators and supervisors remains critically important to a predictable and sustainable business environment and to ensure that we understand and can proactively manage increasing regulatory change.

We work closely with the Ministry of Labour and Ministry of Finance to help deliver services to our members, maintain good relationships and share authoritative and updated information to properly interpret and implement regulatory requirements.

We routinely assess the risks posed by regulatory changes and employ compliance, risk and regulatory management teams to ensure effective implementation of regulation. The Fund actively participates in the engagement with policymakers and regulators across our footprint at national, regional and local levels across each of the Fund’s key markets – including, but not limited to Kenya, Rwanda and Tanzania where we hold investments.

Through this, we have continued to develop mutually beneficial partnerships that allow NSSF, often along with our ecosystem partners, to:

This has enabled us to have constructive, collaborative relationships and dialogue with regulators and government.

Key Highlights

Quality of relationships

We are committed to transparency in our relations with URBRA, as applicable, Parliament of Uganda, Ministry of Labour and Ministry of Finance, and Inspectorate of Government (IGG) among others, to achieve different purposes. For instance, our legislators, (MGLSD), Ministry of Finance, URBRA, as applicable, and IGG played a critical role in bringing insights into our corporate governance. Key matters which become significantly more prominent during the FY, are those dealing with governance, leadership and corruption. Following recommendations from the probe, there were no findings of corruption. The matters concerning governance and leadership were identified as short to medium-term challenges, most of which were addressed and resolved by the end of the financial year.

We are currently undertaking proactive measures to steer our reputation in a positive direction. We assure our regulators and stakeholders that we remain committed to achieving our mandate and that we continue to place special focus on strengthening corporate governance and ethics, and stability of the Fund.

We also continued to offer our skill and expertise in contributing to government consultations to share our point of view on the laws and regulations in the sector in order to safeguard the unique characteristics of the Fund and social security/pensions sector.

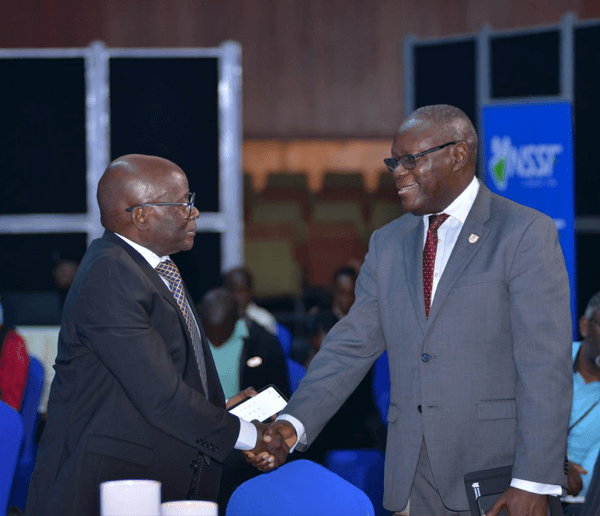

Martin Nsubuga, CEO of URBRA shaking hands with the NSSF Chairman at the AMM

Our Fund Supervisors

In living up to our purpose of making lives better, making savings a way of life and enabling more and more people to take charge of their financial wellbeing, a number of Fund activities required regulatory authorisation, guidance, licensing and/or registration with various key regulators.

During the reporting period, the Fund continued to commit to complying with and conducting business in accordance with relevant regulatory requirements. Our alignment with emerging regulators’ key business plans in making our members’ lives better continued. Several of our activities were and are therefore authorised, controlled, supervised, and regulated. We remain dedicated to transparency, accountability, and ethical leadership, readily acknowledging areas for improvement as we strive to become the premier social security institution in East Africa.

As a result, our senior leaders and Board commit a significant amount of their time to meeting with our regulators and policymakers, providing opportunities for us to understand their needs, expectations and priorities and to keep them informed about developments in our business.

In addition, our businesses and control functions engage with regulators in a variety of ways, such as reporting on compliance with laws and regulations, policy recommendations and participation in industry collaborative initiatives and ad hoc requests. This has strengthened our ability to manage the safety of the pension system and our commitment to continuous improvement in pursuing our mission to foster shared prosperity among our members, the economy, and society at large.

Our Legislative Engagements

The legislators continue to play a key role in shaping the pension sector and creating limitless opportunities for our people. Through the recently enacted NSSF (Amendment) Act 2022, we are expanding social security coverage and enriching the range of benefits available to savers. This legislation is designed to promote shared prosperity by ensuring that all employees are safeguarded and empowered to lead better lives. It enables savers to invest in their future and plan for retirement, thereby establishing financial security for themselves and their loved ones.

Our partners: the National Organisation of Trade Unions, Central Organisation of Free Trade Unions, Federation of Uganda Employers also continue to participate in this process to make these new possibilities a reality.

We have and continue to work with the Ministry of Gender, Labour and Social Development on corporate governance and leadership issues, budget guidance, various partnership reach, and regulations issuance to guide on the implementation of the Amendment Act 2022, specifically on increasing coverage in the sector.

Overall, the Ministry of Gender, Labour and Social Development provides supervision on matters relating to social security while the Ministry of Finance and Economic Development supervises on matters of finance and investments relating to the Fund.

Protecting our Customers’ Financial Data

Protecting our customers’ personal and financial information and handling confidential information responsibly remains top priority. We have put in place robust internal controls, policies and security measures designed to keep this information safe, utilising a wide range of technological, administrative, organisational and physical security measures. As a result, we have collaboratively engaged with the Financial Intelligence Authority (FIA) to improve our expertise relating to the typologies and trends relating to money laundering, and factor these into our risk management framework.

Our customers expect us to be transparent and communicate how we are handling their financial information. We strive to provide them with clear, user-friendly explanations of our privacy practices, including how and why we collect information relating to any suspicious transaction. We do this through a wide range of technological, administrative, organisational and physical security measures especially for our Voluntary Contribution Members remitting large cash amounts as part of engagements relating to Know Your Customers (KYC).

Our Approach to Tax Growth

We recognise that tax sustains and safeguards long-term growth value and enhances the reputation of communities in which the Fund operates. Additionally, it contributes to promote shared prosperity.

In the financial year, we continued to act lawfully and with prudence in our responsibility to comply with tax statutory obligations and disclosure requirements. The Fund maintained open and constructive relationships with the Uganda Revenue Authority. Our tax contributions for the reporting year, were as follows:

| UGX 168Bn | Taxes collected on behalf of government |

| UGX 25Bn | Taxes paid to government |