OUR STRATEGY

STAKEHOLDER ENGAGEMENT

AND VALUE CREATION

Understanding our stakeholder needs and expectations

We can only achieve our purpose by working together with our stakeholders to understand their needs and expectations. We actively involve all our stakeholders, who have different interests, in an ongoing process of collaboration. Our goal is to create solutions that improve the quality of life for everyone working in the private sector, including non-government organisations.We aim to provide a safety net against life's uncertainties by offering comprehensive social security services. Moreover, we acknowledge our role as a responsible corporate citizen, striving to create sustainable value for our members, stakeholders, and society as a whole. We are dedicated to implementing practices that focus on environmental, social, and governance (ESG) principles, aiming to ensure our long-term success.

The Fund also actively engages with these stakeholder groups to gain insights into their needs, and perspectives, and to share information about our strategy, practices, and performance. Our reputation depends on and is also influenced by stakeholder perceptions, which in return affects our performance. We have a shared responsibility to engage with stakeholders across all aspects of our Fund's operations and functions, utilising various communication channels.

Our stakeholders include oversight bodies, other government entities, trade unions, media, professional associations, specific individuals, service providers, members, as well as the Fund's management and staff.

Stakeholder management and governance

A Board-approved Stakeholder Engagement/Management Policy guides stakeholder management and governance, in line with the Fund’s overall business objectives. The Board, through the Staff and Corporate Affairs Committee, has the ultimate responsibility for our stakeholder engagement.

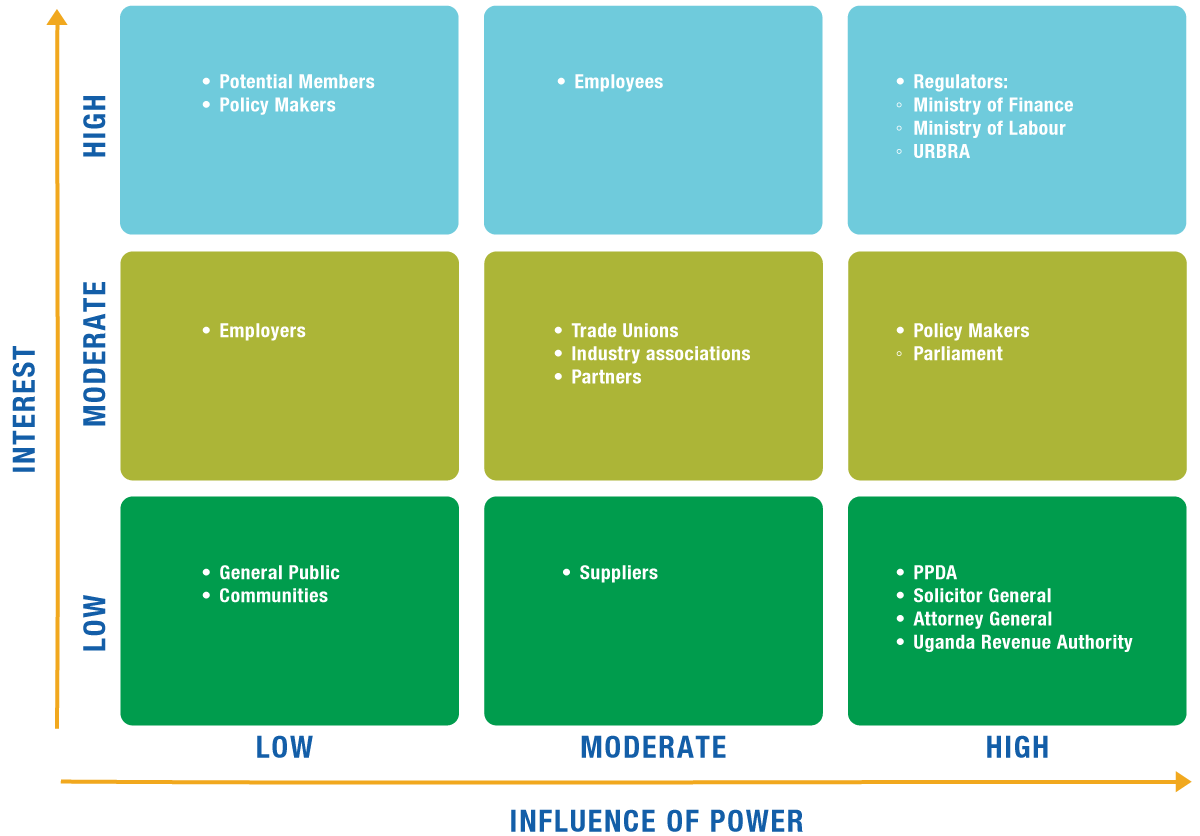

STAKEHOLDER INTEREST AND INFLUENCE MATRIX

Quality of stakeholder relationships

We measure the quality of stakeholder relationships through defined metrics to monitor satisfaction levels on an ongoing basis. Overall, for the period under review, we believe that through focused engagement with our stakeholders, we have maintained healthy and mutually rewarding relationships.

Below, we demonstrate our commitment, engagement, and quality of our relationships with key stakeholders through the value we have delivered.

Meeting Expectations

Falling Short of Expectations

Customers (our members and potential members)

Needs and Expectations

- Excellent customer service and advice

- Timely turnaround times for payout of benefits

- Competitive return on savings

- Support beyond retirement

- Efficient and convenient engagement channels

- Products to meet long-term and short-term savings needs

Strategic Response to deliver value

- Ongoing customer surveys to measure performance and identify areas of improvement

- Further refinement of core systems to improve turnaround times

- Building strong relationships through engagement channels, and partnerships

- Supporting members beyond retirement through financial literacy and support for entrepreneurs

- Campaigns to increase awareness, compliance and saving

Performance measures/value delivered

- Customer satisfaction index 88% (2022: 82%)

- Turnaround time for payment of benefits 11.9 days (2022:12 days)

- Seed funded 147 Women entrepreneur small and growing business with USD20,000 each, so far creating and sustaining 1,700 direct jobs, and 37,000 indirect jobs.

- Designed and tested solutions to support voluntary savings products rollout.

Opportunities and outlook

- Develop and deepen the concept for KYC and 360-degree view of our members

- Implement Voice of the Customer Led Designs and continuously improve our processes, systems and channels to improve turnaround times

- Rollout convenient products and services to increase coverage

Risks

- Inability to engage and educate members and the public on opportunities to save as per the NSSF Amendment Act 2022

- Inability to meet short-term and long-term savings needs

Quality of Relationship

Employees (our staff)

Needs and Expectations

- Recognition, reward and benefits

- Diversity and inclusion

- Employment security, safety and wellbeing

- Growth, learning and development opportunities

- Provide enabling tools

- Improved communication and engagement

Strategic Response to deliver value

- Ongoing employee surveys to measure engagement and identify areas of improvement

- Continue to create a work environment for employees to thrive

- Implement training, development and growth opportunities like the Pathfinder Catalyst Academy

- Continue implementing reward and recognition best practices

Performance measures/value delivered

- Employee satisfaction score 86% (2022: 92%)

- Rolled out the Pathfinder Catalyst Academy and graduated 30 female staff

- Holistic health and wellness programme for staff and their families

- Board, management and CEO quarterly engagements with staff

- Implemented policies on human rights, equal opportunities, labour conditions, ethical conduct, and environmental protection in the workplace to include 51 women acquired new jobs out of the 116 available and we conducted work and safety training

- Completed organisation restructuring aimed at aligning Fund to new business model

Opportunities and outlook

- Promote and grow the Pathfinder Catalyst Academy to achieve 40:60 gender ratio by 2030, ensuring that women occupy at least 40% of managerial positions

- Increase staff satisfaction

- Improve our talent development and management practices

- Continue improvements in celebrating diversity and collaboration among employees from various backgrounds

Risks

- Inability to engage and educate members and the public on opportunities to save as per the NSSF Amendment Act 2022

- Inability to meet short-term and long-term savings needs

Quality of Relationship