OUR BUSINESS

RETIREMENT JOURNEY

BENEFITS OF SAVING WITH NSSF

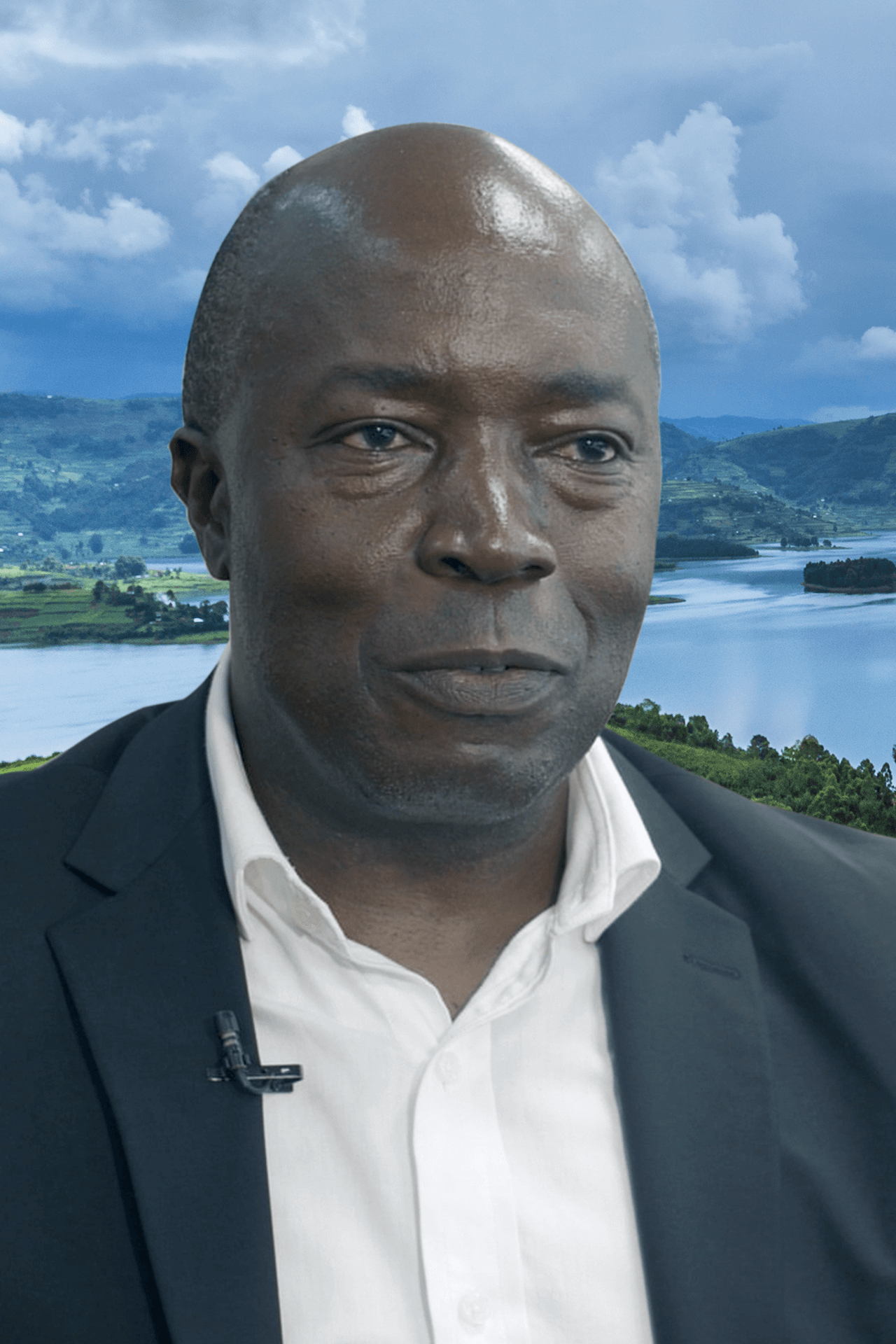

Meet Francis Kamulegeya, one of our members who embarked on his savings journey early in life, demonstrating how wise financial planning can lead to a secure and fulfilling retirement. His inspiring story not only highlights his successful financial journey, but also highlights how he generously gave back to the community, leaving a lasting impact.Tell us about yourself

My name is Francis Kamulegeya, I am married with 4 lovely daughters.

I recently transitioned out of full-time employment after 27 years of employment. By my retirement, I was serving as Managing Partner for PwC Uganda, a member of the PwC Africa Governance Board, and Head of Tax in Uganda.

I am currently self-employed in the agriculture value chain sector, specifically farming, encompassing the cultivation, roasting, processing, packaging, and sale of coffee. I am also involved in pond fish farming, focusing on Tilapia and Catfish .

I would not describe myself as retired because I am busier than ever before. Currently, I hold positions on four different Boards of Directors, with my most recent appointment being as Chairman of Buganda Land Board. I also run five different family businesses with my wife, friends, and partners.

When did you start your saving journey with NSSF?

I began my formal savings journey at the age of 24, approximately 31 years ago, while I was both working and pursuing my studies in the UK (United Kingdom).

This allowed me to save for my school fees, which proved to be a successful strategy. Through my savings, I was able to self-finance my education in accountancy, finance, and taxation, obtaining the qualifications that enabled me to join PwC in London.

I continued saving and bought property in England until 2003 when I returned to Uganda.

I subsequently became a member of NSSF and continued saving with them until December 2022 when I reached the age of 55 and received my retirement benefits.

When you commenced your savings journey with NSSF, how did you feel?

I have always considered myself to be financially literate even before I studied finance and accounting. My financial awareness goes back to my early days as a young boy in Masaka, where I engaged in small trades and earned money. As a student in London, I had to pay my own tuition fees, so it was a no brainer for me to start saving.

Unlike the sentiments we find in other people, I always looked at saving as one of the ways of securing my own future but most importantly looked at saving as a way of rewarding myself, since spending means you are rewarding someone else.

I had a very disciplined culture of saving. The one thing that got me well-grounded was a course I attended in 2003 about Personal Financial Planning where the instructor clearly emphasised the importance of saving and how to improve your current savings using a simple rule of thumb (divide your age by 2, take that as a percentage of your gross income, and that is how much you should be saving). According to this rule, the earlier you start saving, the lower the percentage of your income you need to set aside, especially when considering NSSF, given the power and magic of compounding.

How did you utilise your retirement benefits?

I planned to retire before my formal retirement age of 60 in PwC. I decided to retire at the age of 55, with a well-thought-out plan in mind.

My goal was to access my retirement benefits, supplement them with my other savings, and combine all income from my passive investments to support my various projects.

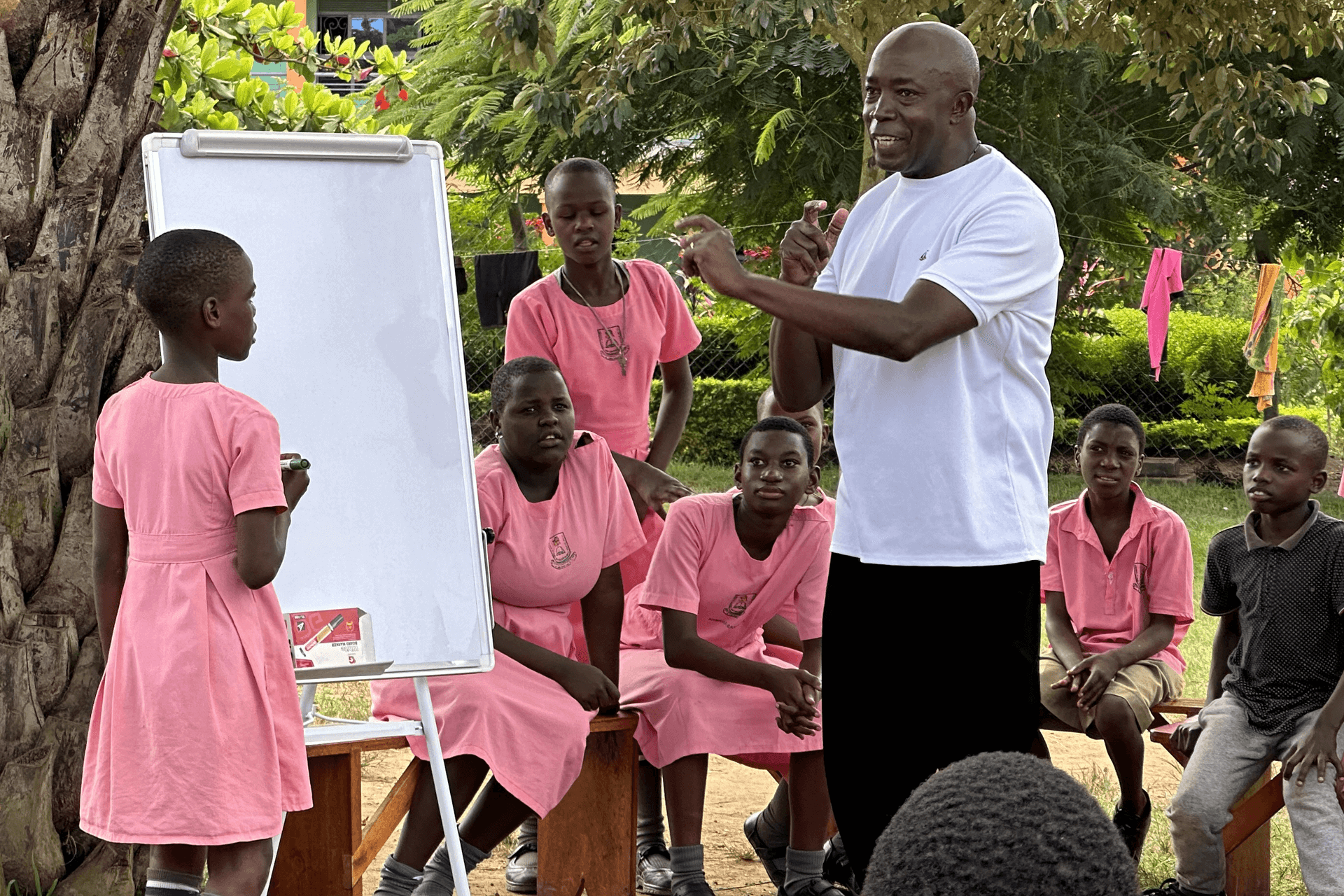

One of the projects I have been running in my home city of Masaka is a school for special needs children that I initiated in 2003. This social project was kickstarted with personal funds and support from friends, family, and well-wishers to provide education to deaf children. Unfortunately, when these children finish primary level 7, the options for secondary education are severely limited due to financial constraints, a scarcity of special needs education secondary schools, and high unemployment rates.

To address this gap, in 2020, I took the initiative to establish a vocational training institute to provide opportunities not only for these children but also for the wider community in the greater Masaka region. This decision was motivated by the pressing need for specialised vocational training, the high unemployment rates, and a shortage of skilled entrepreneurs.

Using my retirement benefits and other savings, I launched the institute, which I believe is of world-class quality in terms of its spaciousness and well-equipped facilities. It is my dream to transform it into a centre of excellence, offering a range of skills, training programmes, particularly targeting Ugandans in the southern region who will be working on the oil and gas projects along the pipeline route that passes close to my village in Kyotera.

The retirement benefits helped me to advance projects that I have always been deeply passionate about, projects that would have a long-lasting impact on society, and will continue to thrive after my time. This kind of social project was not only fulfilling but also addressed a need I had identified over the course of many years.

Furthermore, the project has proven to be income generating, and has the potential to be profitable once fully operational. It aligns perfectly with the current needs of our country.

What message do you have for people struggling to save money, or having challenges with managing finances?

When you advise people to save, they always put it off, thinking that it is not for now, they believe you first spend and then save whatever is left later. My message to young people, especially is that if you are planning to live longer, note that today everything is different. Improved medical care, wellness programmes, higher levels of education, improved standards of living, mean that the mortality rates are lower and life expectancy is higher. It is sad to live longer when you are poor, and you become a burden to everybody. Social security is a means of saving for yourself. If you want to have a good life, you must plan better. Before you think of retirement, have a plan of how you will live your life after employment and that plan starts now.

As you are spending, put some money away to take care of yourself in the future. Saving is a reward to yourself and a way of shielding yourself from financial burdens that you may experience later in life.

Take care of the long-term benefits, in terms of medical products, investments, and saving for school fees.

Manage your debts better. For you to be able to clear a debt, either you have an investment to liquidate or savings to pay off the debt. Ensure you take care of your debts so that you are not tied down to working because of a running debt.

Financial independence should be the goal. Do not work because you have no option, live within your means, define your own success, and most importantly make sure you save to a point where your savings work for you.

What message do you have for people planning to take their retirement benefits?

Retirement does not mean stopping work and returning to one’s village to quietly await the end. It means planning for a long, fulfilling, and extended life during retirement.

Retirement planning goes beyond finances; it is about taking charge of your life. It means waking up each day with the freedom to pursue your passions, wherever, whenever, and with whomever you choose. The goal is to retire from work, not from life itself. Money should serve as a way of enhancing your life experiences. Focus on having something to retire to, rather than merely retiring from your job.

If you do not have a plan for your savings yet, do not withdraw your money until you have one. Your benefits are very safe with NSSF. Until you have a plan, those benefits will be making more money for you in terms of earning interest through the power of compounding.

The NSSF team possesses expertise in various investment options, including real estate, equities, money markets, foreign exchange trading, treasury bills, and shares, all with competitive returns. When withdrawing your benefits, ensure you have an investment project offering better returns than NSSF.

Avoid investing in unfamiliar projects, especially those with long payback periods like real estate. Seek financial planning before committing your funds. Instead, consider withdrawing part of your benefits until you have a well-defined investment plan with superior returns.

There comes a time when liquidity is crucial, and your assets, such as land, may not provide immediate help. It is easier to withdraw retirement benefits from NSSF when needed, compared to selling property in emergencies.

As retirement approaches, view it as a transition from your current roles and responsibilities to a new phase with different ones. Reflect on:

Considering these factors will help you make informed decisions about your retirement benefits and the new chapter in your life.

Having accessed your retirement benefits, what advice do you have for the people saving or planning to start saving with NSSF?

The concept and awareness of saving is there, it is just that it is informal, not well regulated, and not well structured. Now you can with NSSF.

The new regulations make it possible for anyone to start saving with NSSF, without limitations on the nature of employment, the number of employees or voluntary contributions.

These changes offer flexibility to start your savings journey with NSSF.

Take advantage of the upcoming voluntary schemes and products that align with your means.

Allow your savings to generate returns and secure your retirement. Social security has evolved from relying on extended families to ensuring your ability to maintain your lifestyle beyond your working years.