OUR BUSINESS

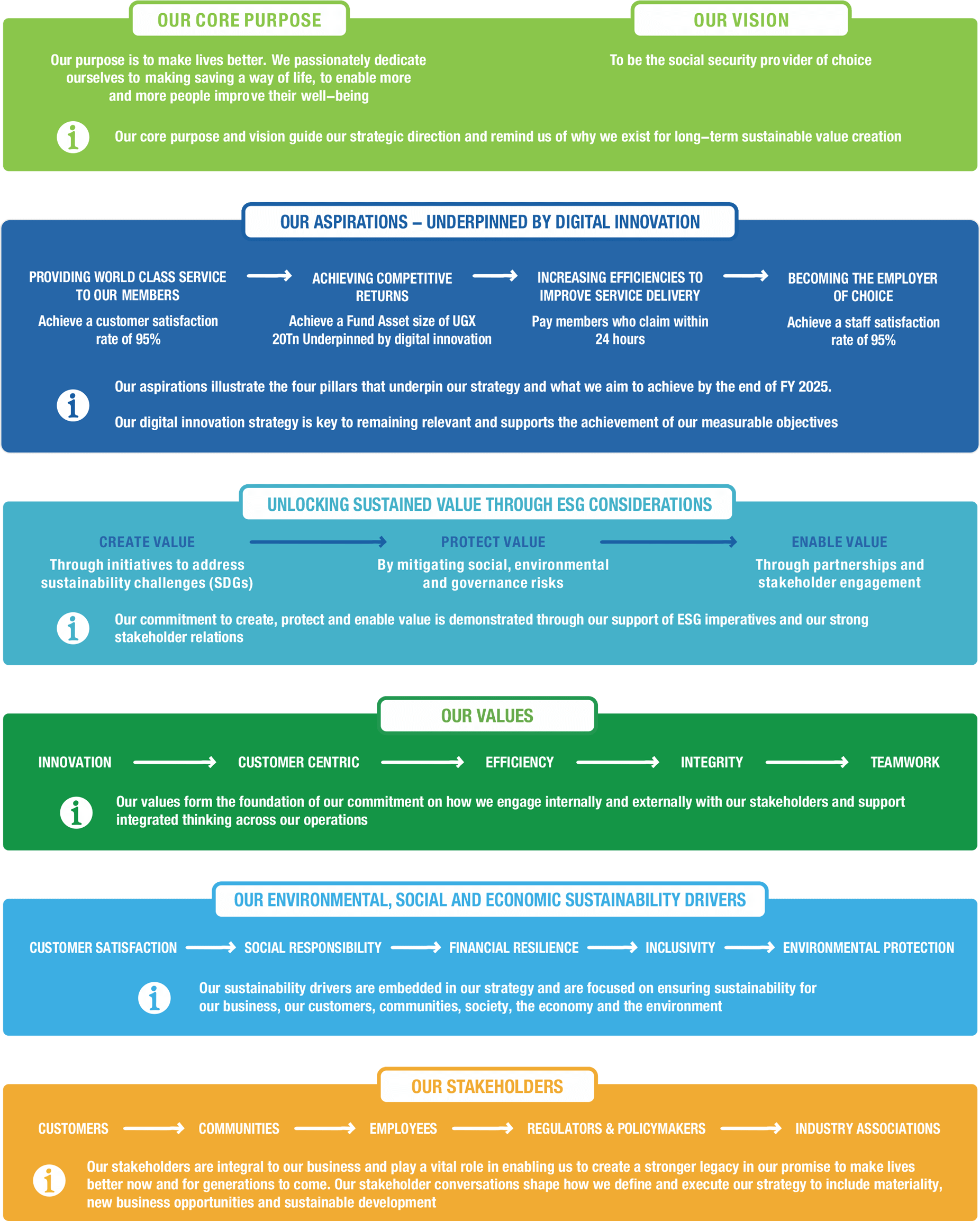

OUR STRATEGY

Strategy @ a Glance

Our FY 2025 Strategy commenced in 2015 and remains relevant in our operating context, despite uncertainties in the external environment. The illustration below depicts an overview of our FY 2025 Strategy.Key Risks impacting achievement of Strategy

MARKET RISK - FOREIGN EXCHANGE

The Fund's revenue stream is at risk due to regional market volatility and currency fluctuations, leading to unrealised losses resulting from the appreciation of the Ugandan shilling against the Kenyan shilling

REPUTATION RISK

Ongoing investigations have created a reputational risk, impacting internal processes, staff, and member services

COMPLIANCE AND LITIGATION RISK

The increasing number of cases being filed against the Fund poses a potential risk to its operations and reputation

TECHNOLOGY FAILURE AND SYSTEM DOWNTIME RISK

The instability of the core system presents a risk as most of the functionality remains unoptimised, hindering the realisation of the full benefits of OctoPAS

LIMITED PRODUCT RANGE RISK

The Fund faces the risk of potential missed opportunities to provide additional value to members due to the absence of drafted regulations

INTEGRATING ESG INTO OUR FY 2025 STRATEGY

Good corporate governance is implemented in an integrated manner, promoting an ethical culture, good performance, effective control and legitamcy

2023 HIGHLIGHTS

Providing world-class service to our members

Achieving competitive returns & sustainable growth

Increasing efficiencies to improve service delivery

Becoming the employer of choice

Reflection on strategy for the period under review

As we enter the ninth year of executing our 10-year strategy, we take great pride in the milestones achieved and the unwavering commitment to our core objectives. Our strategy continues to centre around four primary goals, which serve as the bedrock of our success:

We recognise our broader responsibility to society and the environment. As a socially responsible organisation, we have taken proactive steps to integrate sustainability drivers within our strategy. Aligning with the United Nations Sustainable Development Goals (SDGs), we have prioritised initiatives that seek to make a positive environmental and social impact.

In line with our commitment to Environmental, Social, and Governance (ESG) practices, we strive to go beyond mere financial gains. We envision a future where our Fund plays a pivotal role in driving positive change, nurturing a sustainable ecosystem for generations to come.

Looking ahead, we remain confident that our business is well positioned to continue delivering strong performance in both the medium and long term. Our continued focus on innovation, customer-centricity, and sustainable practices positions us at the forefront of the industry.

None of these accomplishments would have been possible without the unwavering support of our stakeholders, valued members, dedicated staff, and visionary leadership.

As we venture into the final two years of our 10-year strategy, we remain steadfast in our commitment to excellence, sustainability, and responsible growth. Together, we are building a brighter future for our members, our community, and the world at large.

Highlights for the year

In the last financial year, the Fund made significant strides towards its long-term goals, exemplifying dedication, innovation, and empowerment. It focused on delivering value-adding products and services, streamlining processes, and forging strategic partnerships. By adopting a client-centric approach and adhering to regulatory compliance, the Fund laid the foundation for continued growth and positive impact on the financial landscape.

One of the major achievements was the establishment of the Debt Recovery Unit, strengthening compliance efforts and providing crucial support to the Legal Department. Compliance improved to 57%, surpassing the target of 52%, showcasing the unit's effectiveness in upholding financial integrity and resolving outstanding debts.

The Fund's commitment to responsible investing continued with a focus on ESG-compliant companies, aligning its portfolio with ethical principles and contributing to sustainable global development. Additionally, the Fund initiated the Hi-Innovator programme, with the aim of providing seed funding for up to 500 start-ups and creating 132,000 jobs by 2025.

This programme also provided foundational business knowledge to the public, empowering aspiring entrepreneurs with essential skills and insights.

Furthermore, the Fund implemented strategic initiatives to enhance its workforce, such as the Pathfinder Mentoring Programme and the Pathfinder Catalyst Academy. These initiatives empowered employees with professional development opportunities, fostering a culture of continuous learning, and promoting gender equality and women empowerment.