OUR BUSINESS

MATERIAL MATTERS

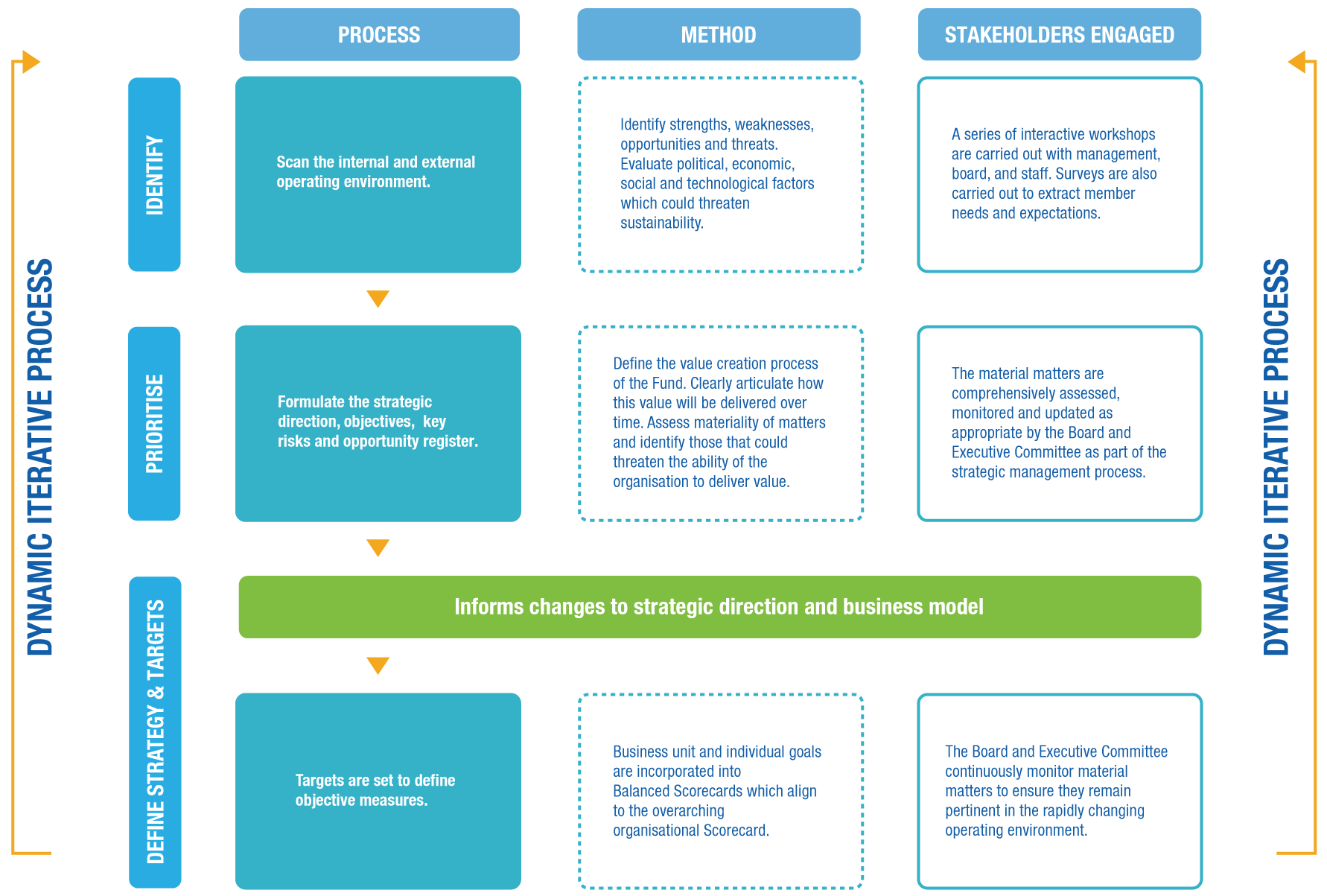

MATERIAL MATTERS PROCESS

Material matters are those issues that could substantially affect our ability to create value in the short, medium and long term. These matters influence our strategy and how we manage our associated risks, as well as opportunities we explore as a result of these factors.

The process we follow to determine our material matters is as follows:

The outcomes of our materiality process resulted in the prioritisation of the following materiality themes:

Governance Challenges

Material Matter - Management and Board conflicts, Appointment of a substantive Managing Director

The Fund has been subject to thorough investigations by government bodies, including the Parliamentary Committee, the Auditor General, and the Inspector General of Government (IGG). Our active cooperation reflects our commitment to transparency and accountability in maintaining high governance standards.

Risks

Mitigation Response

Opportunites and impact on business model

Targets

Strategic Objectives

Capitals Impacted

Regulatory change

Material Matter - NSSF Act Amendments

The NSSF Amendment Act 2022 was passed into law in January 2022. The Fund is now mandated by law to provide social security services to all workers in formal and informal employment within the private sector. Under provisions of the NSSF Amendment Act 2022 anyone can now save with NSSF for their retirement.

Risks

Mitigation Response

Opportunites and impact on business model

Targets

Strategic Objectives

CAPITALS IMPACTED

Global Economic Uncertainty

Material Matter - Slow economic growth and macro economic variables

The Russia-Ukraine conflict, initially perceived as short-lived by many, has grown into a global crisis, disrupting economies. Its far-reaching consequences are anticipated to leave a lasting impact on the economic, social, and political landscape, heightening business uncertainty. Post-election unrest in Kenya has prolonged, escalating internal political tensions and exacerbating economic challenges. Furthermore, terrorist activities expanded into Uganda and Kenya, causing fatalities and trade downturns.

Risks

Mitigation Response

Opportunites and impact on business model

Targets

Strategic Objectives

CAPITALS IMPACTED

Digital Acceleration

Material Matter - Our new Pension Administration System – IT infrastructure upgrade

The Fund implemented new robust core pension system in December 2021 to improve efficiencies, enable product innovation and create a seamless experience for our customers.