OUR REPORT OVERVIEW

OPERATING CONTEXT

BUILDING RESILENCE FOR INCLUSIVE PROSPERITY

The year ended June 2023 was one of mixed fortunes. We witnessed significant recovery of many companies from the effects of Covid-19 while others completely shut down after failing to rebound to the pre-covid-19 era. It was a year in which business resilience was tested and those that had built well tested survival mechanisms soared to greater heights.”Achievements in the financial year

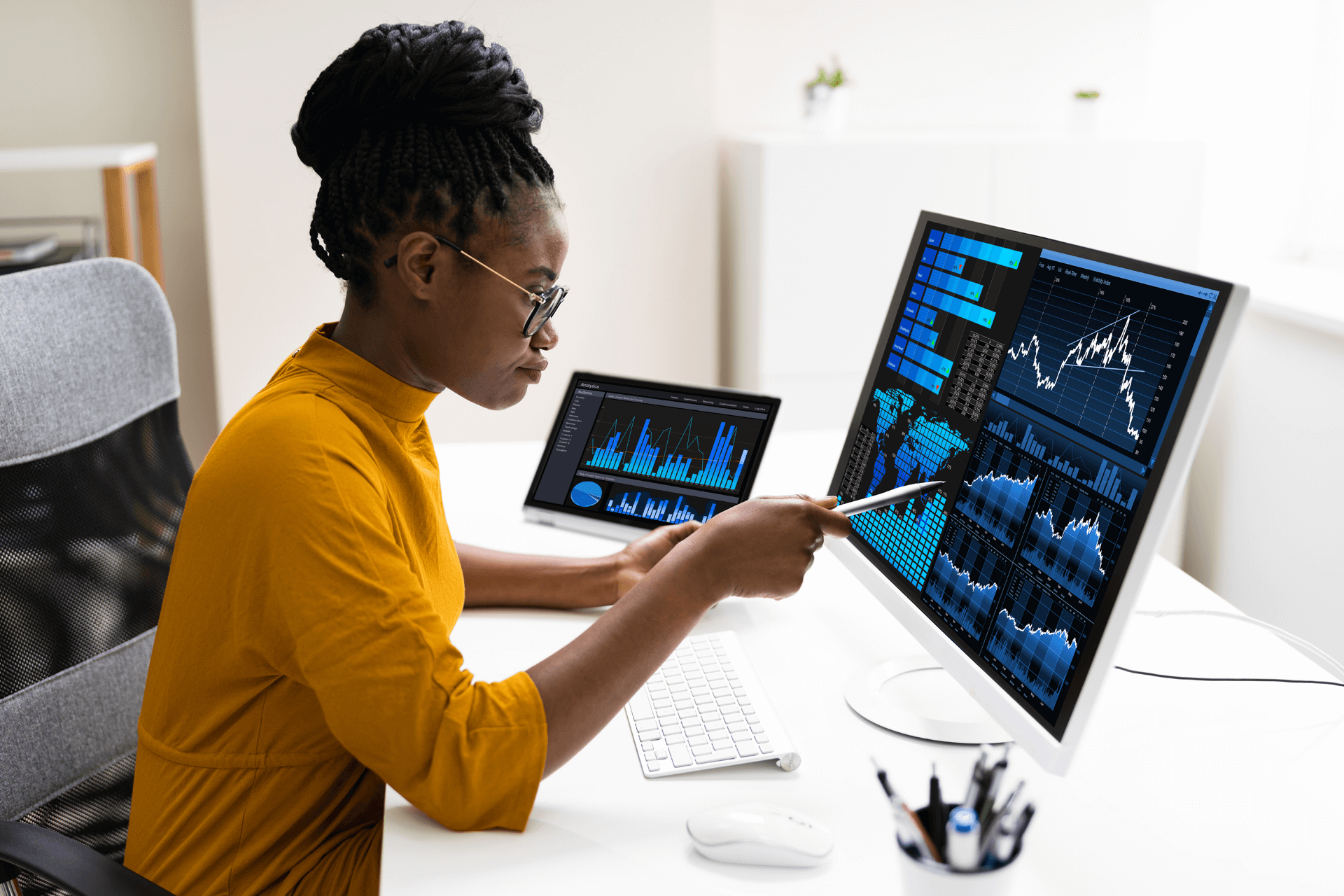

The Fund achieved 15% growth in contributions from UGX1.49Tn to UGX1.72Tn compared to the previous year. This was the highest collections growth rate in over 10 years and was more than double the 7.8% growth registered the previous financial year. Active membership increased to 733,558 members from the 651,788 members at the beginning of the year.

This also marked the year in which provisions of the newly amended Act were being implemented.

Highlights

Impact/Outcome

Outlook for the year ahead

The new year holds great potential. Our target is to collect approximately UGX 2Tn in contributions and to register at least 10,000 new employers.

We look to the future with optimism as we aspire to increase coverage through enabling more people to save. Specifically, we anticipate an exciting and challenging entry into the informal sector while giving formal sector employees an opportunity to save over and above the statutory 15%.

Our plan is to offer members flexibility in the voluntary contributions and benefits design without undermining the need for long-term savings. Recognising the value that partnering brings to the business, we will work to onboard several partners within the formal and informal sectors in our effort to increase coverage and improve compliance among employers. Technology will continue playing a pivotal role in our expansion journey as we plan to improve member experience and engagement.

In addition, we will continue to explore the opportunities presented by our new business operating model premised on portfolio segmentation in our bid to ‘make lives better’ for our members.

Our people play a critical role in business growth, and we are committed to undertaking initiatives aimed at improving staff morale. An agile and resilient staff could be the difference between success and failure as we look to the new year with confidence.