OUR BUSINESS

Financial & Operational Highlights

FINANCIAL HIGHLIGHTS

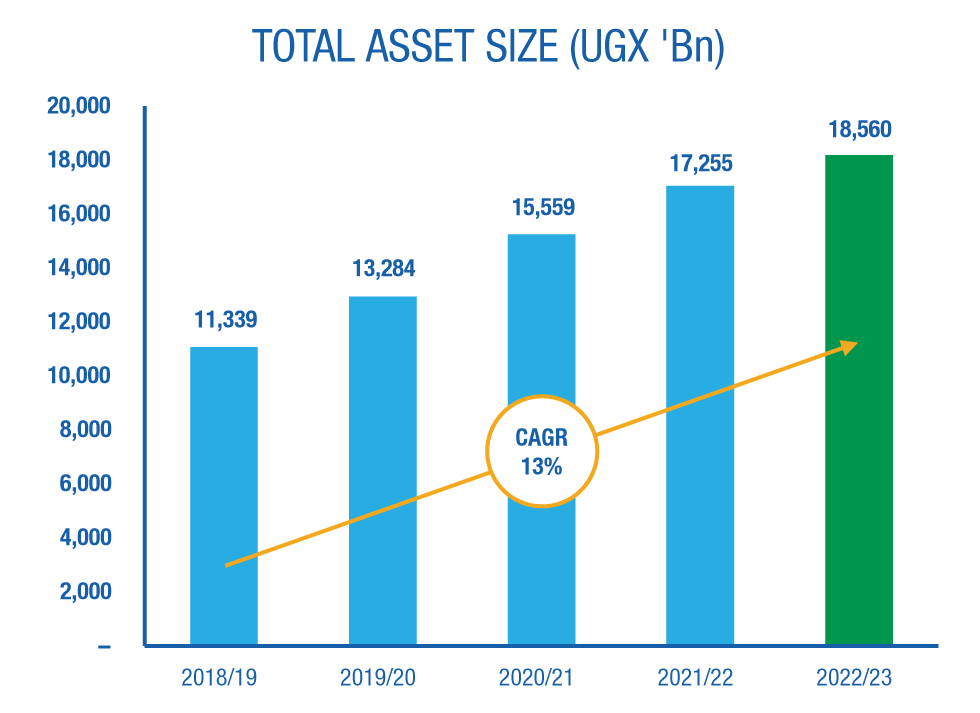

Asset Growth (UGX ’Bn)

Asset size has significantly grown over the past five years posting a CAGR of 13% driven by investment capital expenditure that is undertaken from the increasing member contributions and income generated net benefits paid out.

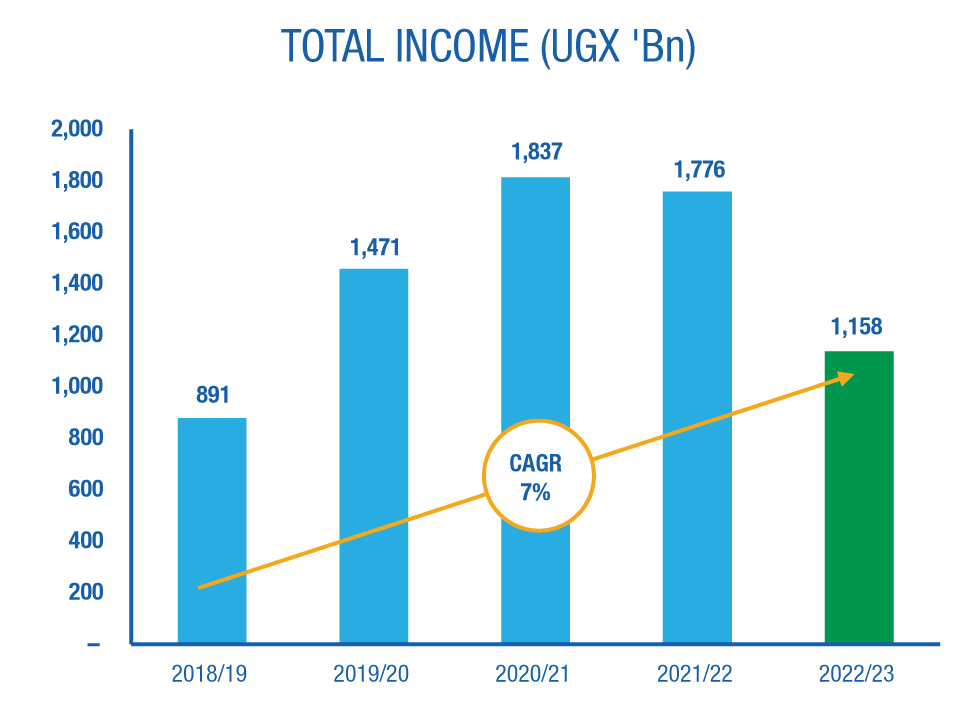

Total Income (UGX ’Bn)

Total income constitutes interest income, real estate income, dividends, share of results from associates and other income earned. This has grown by a CAGR of 7% over the past five years with the major contributor being treasury bonds invested over the East African Region. The decline in FY 2022/23 from FY 2021/22 was due to unrealised foreign exchange and capital losses incurred on our regional investments.

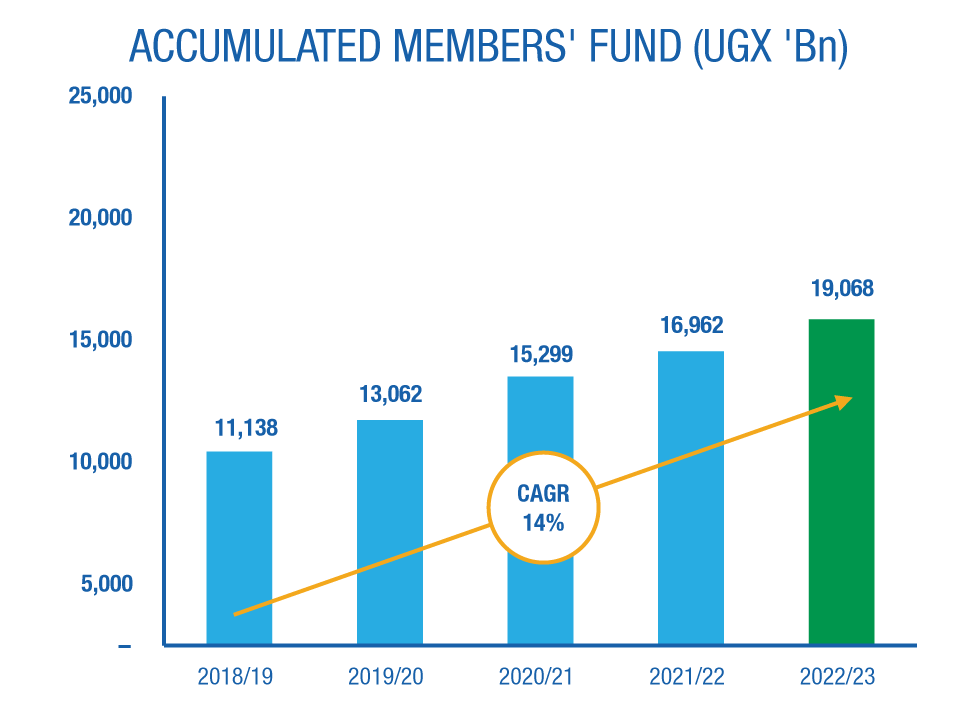

Accumulated Members' Fund (UGX ’Bn)

Accumulated members’ fund constitutes member contributions, interest credited to member accounts less benefits paid out. This has grown by a CAGR of 14% in the last five years driven by the growing member contributions, increasing interest credited to member accounts net of total benefits payouts.

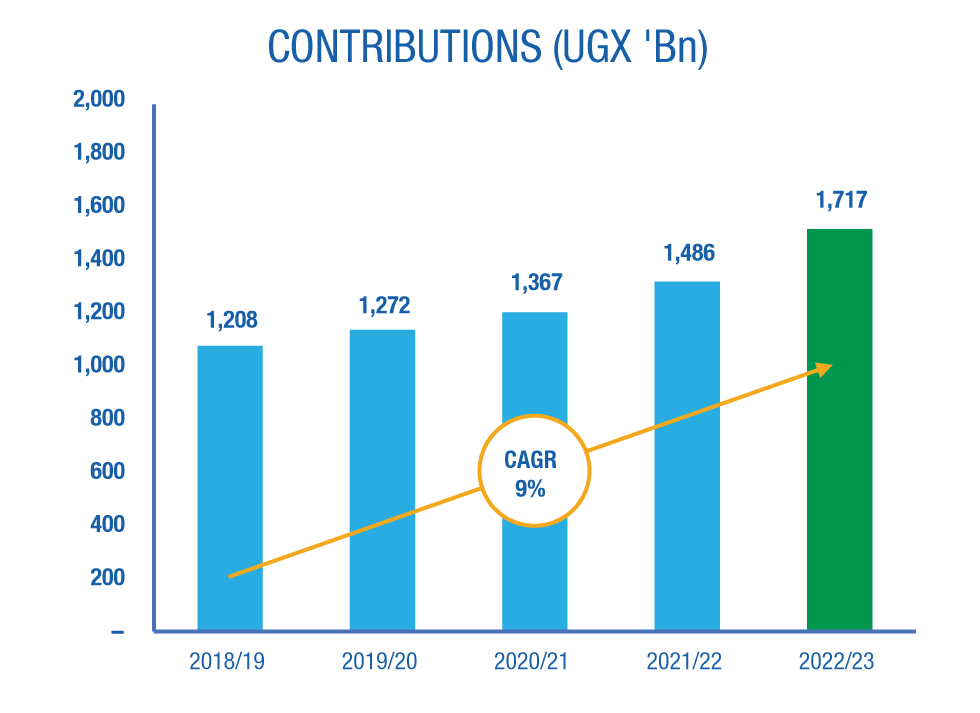

Growth in Contributions Collected (UGX ’Bn)

Contributions from members have grown by a CAGR of 9% in the past five years driven by new members, employers’ increased registration due to change in the legislation and the increased focus on growing voluntary membership in the past five years.

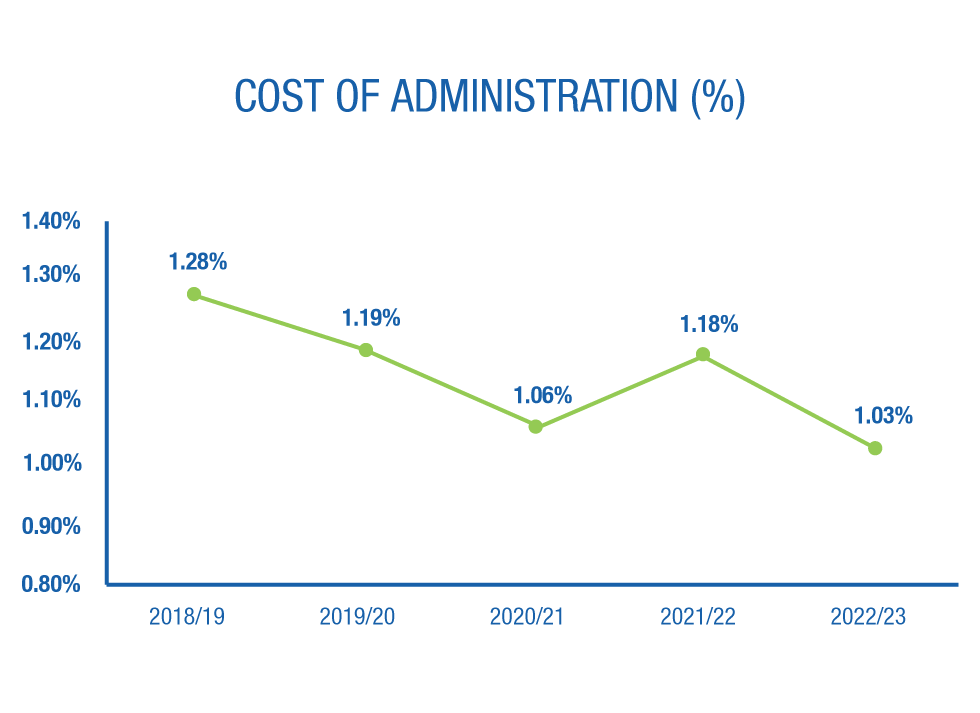

Cost of Administration (%)

The Fund’s Cost of Administration largely reduced due to the Fund’s cost saving mechanisms and the reversal of the unutilised provisions from prior periods.

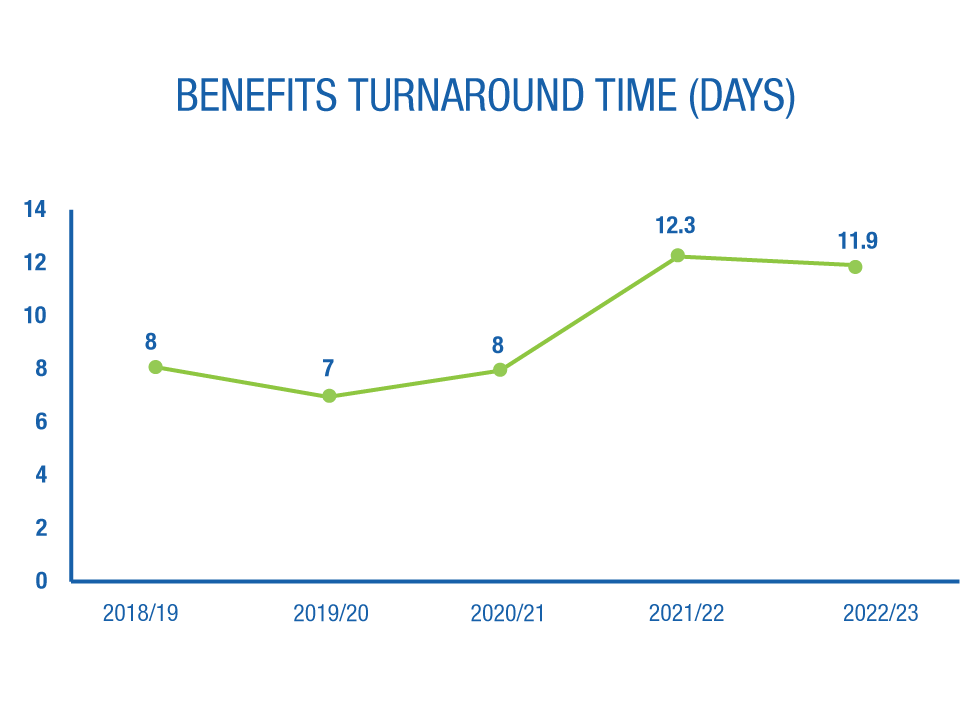

Benefits Turnaround Time (Days)

The turnaround time for benefit payouts was 11.9 days in FY 2022/23. This was slightly better than the previous year because of the improved user experience of the pension administration system.

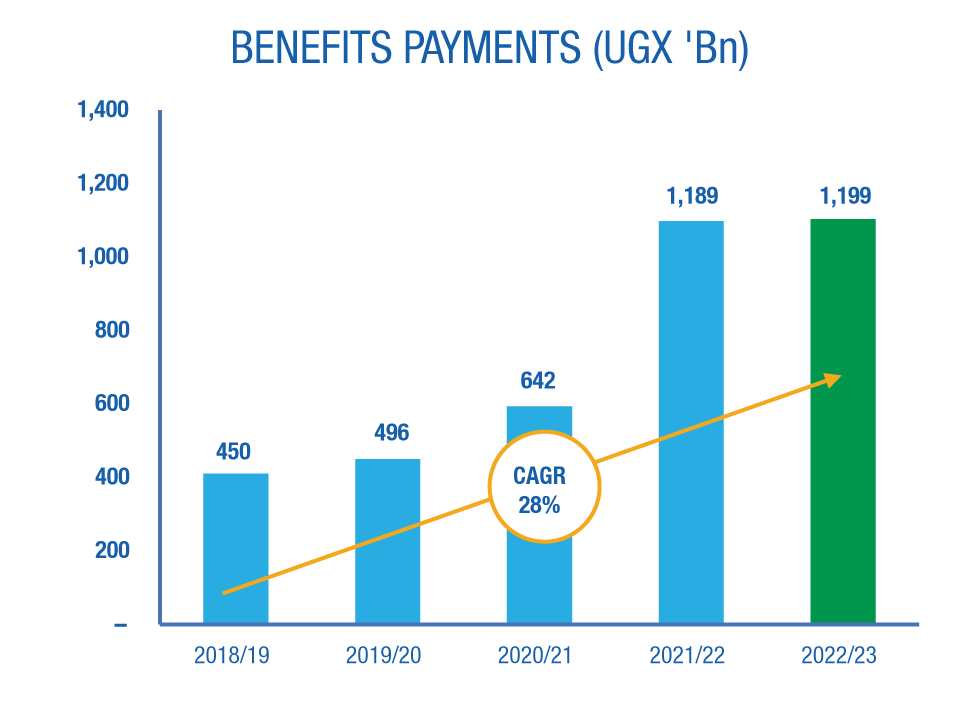

Benefits Paid (UGX ’Bn)

Benefits paid grew by a CAGR of 28% in the last 5 years. The slight increase in FY 2022/23 was due to increased media attention on the Fund that created scepticism among its members that led to increased claims. This later normalised.

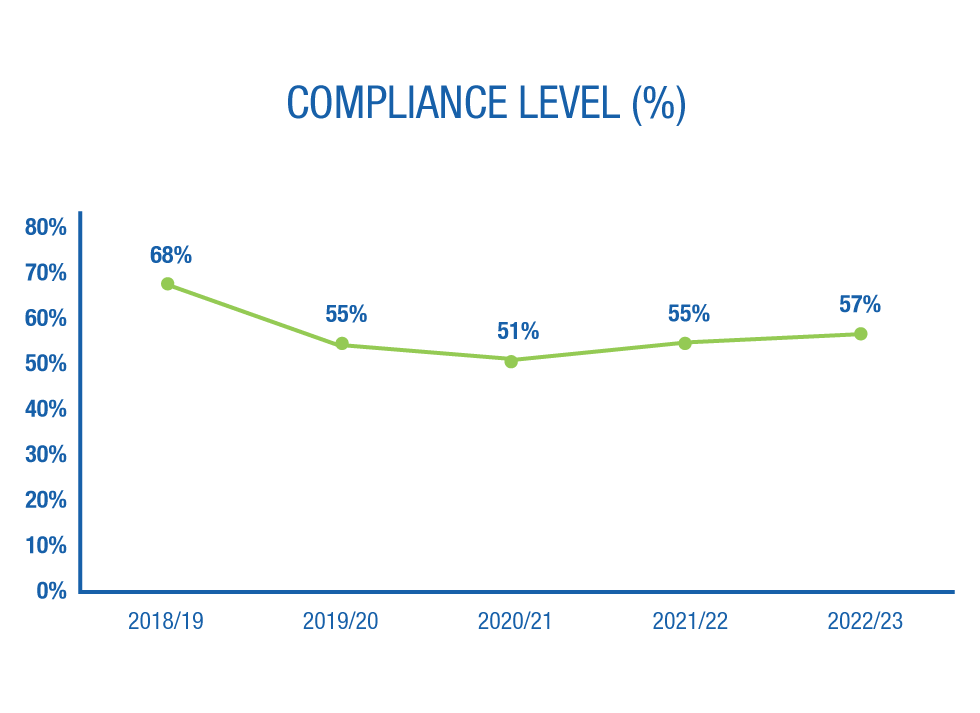

Compliance Level (%)

Compliance for FY 2022/23 closed at 57% as of 30 June 2023. This improved from the previous year due to economic recovery in addition to the Fund’s increased compliance enforcement measures.