OUR REPORT OVERVIEW

MANAGING DIRECTOR'S

STATEMENT

Reflections on the past year

In the face of challenges, FY 2022/23 showcased our unwavering resilience and commitment to excellence. Despite a parliamentary probe, our robust processes in people, procurement, and Governance stood strong. The Funds' performance also remained strong highlighting operational efficiency and dedication to achieving our strategic goals.

We have taken the time to reflect on lessons learned. One of the crucial aspects for our sustainability is to maintain clear and transparent communication with all key stakeholders. We believe in innovative decision-making and need to ensure that there is visibility of our purpose and direction with all stakeholders to be part of this transformative journey.

Vision 2025

Our 10-year strategy continues to steer our direction and growth. We are well positioned to achieve most of our targets by 2024, one year ahead of schedule.

The Fund has continued to earn the goodwill of our valued members and stakeholders. Our reputation and strength remain steadfast. We are attracting top talent and positioning ourselves as a leading organisation within the region.

During the FY 2022/23, amidst the challenging environment, the Fund registered very good performance in the following key financial areas

FUND'S ASSETS

FUND'S ASSETS

Fund’s Assets grew by 7.6% from UGX 17.3Tn in the previous year to UGX 18.6Tn

TOTAL REALISED INCOME

TOTAL REALISED INCOME

Total realised income grew by 15.1% from UGX 1.9Tn to UGX 2.2Tn mainly driven by interest income

DIVIDEND INCOME

DIVIDEND INCOME

Dividend income recognised in the year was UGX 145Bn, a growth of 45.5% from UGX 100Bn the previous year

CONTRIBUTIONS

CONTRIBUTIONS

Contributions collected in the year amounted to UGX 1.72Tn, 15.5% above collections for the previous year. This is a clear testament of the trust and confidence that our members continue to place in the Fund

Despite local and global challenges, the Fund remained resilient..."

Watch video to get the full story...

Vision 2035: Fostering inclusive prosperity, commitment to sustainability and ESG

Building upon our 2025 strategy, we have set ambitious targets for the next decade.

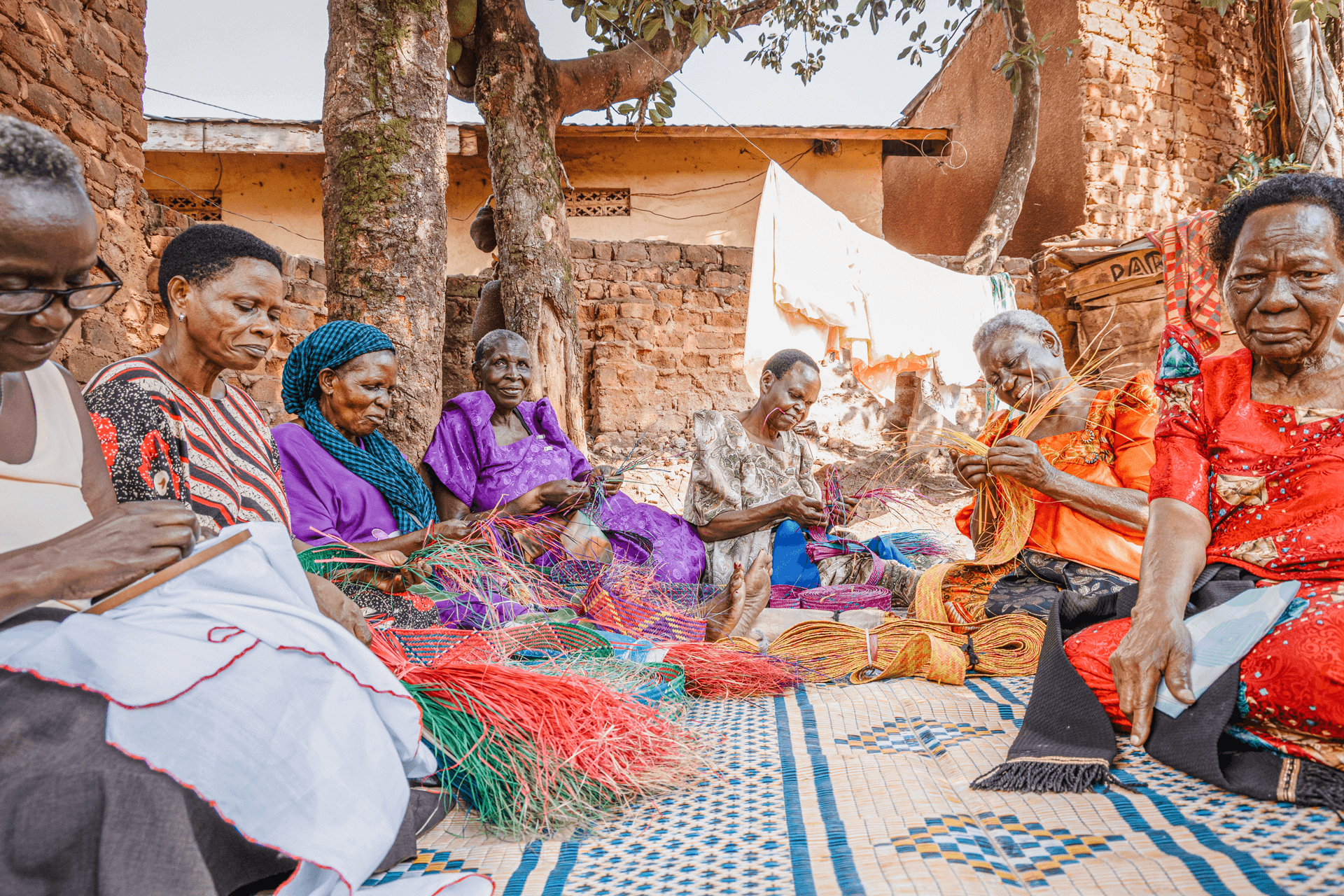

Central to our strategy is an active role in the daily lives of young Ugandans, especially in the areas of agriculture and job creation. By promoting a culture of saving and enhancing the capacity to save, we aim to empower Ugandans to achieve greater financial security and prosperity.

We have seamlessly integrated ESG principles into our operations, solidifying our dedication to environmental, social, and governance responsibility.

This year's inaugural NSSF ESG Report proudly showcases our progress in this regard. Read our full ESG Report.

By incorporating these factors into our strategy, we gain deeper insights into growth opportunities. At NSSF, we understand that embracing sustainability is not only the right thing to do for our society and the environment but also a strategic imperative for the long-term success and resilience of the Fund, building a more sustainable future for generations to come.

Our audacious goal is to grow our member base from the current 10% of the working population to 50% of Uganda’s labour force by 2035. Achieving this goal necessitates our proactive intervention to enhance our members’ capacity to earn and save.

Through our Hi-Innovator Programme, we extend support to promising entrepreneurs, offering seed capital to pave the way for growth and success. By nurturing young talent and stimulating economic growth, we not only empower the next generation but also contribute to the development of Uganda's economy.

Increasing earnings and economic opportunities for our members will be a catalyst for attracting more individuals to join the Fund, enabling growth of our membership and asset base.

Organisational redesign, technology, and innovation

Driven by the NSSF Amendment Act 2022, and throughout the financial year, the Fund pursued the refinement of our Organisational Redesign that is focused on enhancing our processes to better serve our members.

The amendment created opportunities for the Fund to attract voluntary savers. To cater for the diverse requirements of informal savers, we have embarked on creating a comprehensive suite of products to meet their needs. This approach entails adopting a different relationship model, and one that aligns more closely with the specific preferences and circumstances of these savers.

For example, in our quest to meet the demands of our would-be members, we are exploring and negotiating with insurance providers to provide affordable health coverage products that can help such a member mitigate the risk and cost of a serious health problem. The package will include preferential rates for essential services like hospitalisation, accident, and funeral coverage. By doing so, we aspire to provide our savers with enhanced benefits and a more encompassing and holistic financial solution.

Looking ahead: Projections for FY 2023/24

In the upcoming financial year, are focussing on establishing strategic partnerships and collaborations that will capitalise on new opportunities and drive sustainable growth.

We are pursuing Private Public Partnerships (PPP) opportunities to amplify our investments and boost the future cash flows of the Fund.

We are taking proactive steps to further our involvement in the agricultural sector which employs 60% of Ugandans. We are collaborating with the Government to organise the market side of agriculture. We do know that when farmers earn more money, they will be empowered to save for retirement with NSSF.

We believe that by tackling the most pressing challenges faced by our citizens, these initiatives reflect our shared values for sustainable growth.

In conclusion

I would like to thank the Chairman and the Board for their support in developing and delivering on the Fund’s strategic objectives. I also extend my appreciation to the Supervising Ministries for their unwavering support provided throughout the financial year. To all our other stakeholders, thank you for your continued support and mutually rewarding engagements.

My thanks are also extended to the Executive Team, and the entire NSSF staff for their commitment, passion, and dedication to making the Fund a success. Our determined effort shows that we are committed to making NSSF the Social Security Provider of Choice.