OUR GOVERNANCE

SHARED VALUE

Creating shared value through sustainable initiatives to foster shared prosperity

The Fund remains dedicated to being a responsible corporate citizen evidenced by its focused and purposeful CSI activities.

These activities not only reflect our commitment to societal betterment but also align seamlessly with our strong adherence to ESG principles.

As we focus on creating sustainable solutions, our intention goes beyond short-term gains. We are keenly aware of our responsibility towards the environment, society, and governance.

By incorporating ESG considerations into our decision-making processes, we are working towards solutions that not only drive positive financial outcomes but also contribute to a better world for our members, stakeholders, and society at large.

Generating lasting value by fostering shared prosperity among members, the economy and society

As a responsible corporate citizen, we understand the importance of undertaking initiatives that generate lasting value for our members, stakeholders, and society. Through the various corporate social investment endeavors (CSI), the Fund undertakes initiatives that provide positive social, environmental, and economic value to society.

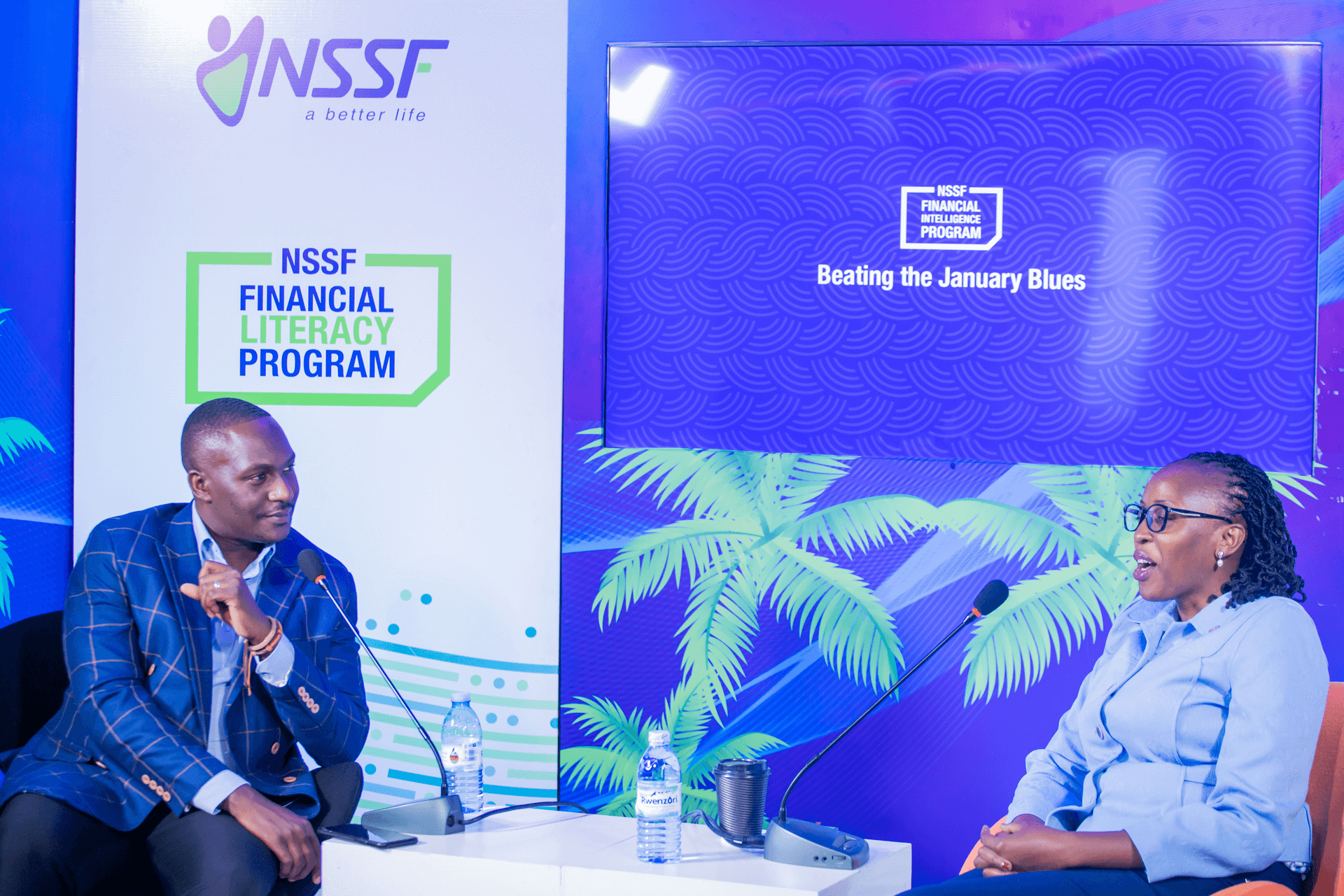

The Financial Literacy Programme

The programme’s core objective is to empower our members and the public to enhance prudent financial decision-making during their employment and after claiming thei benefits.

This programme commenced in 2019 following an internal survey conducted in 2018 that revealed a concerning trend: 90% of beneficiaries exhaust their entire savings within 2 years without putting them to good use.

This programme is aimed at reversing this behaviour and fostering shared prosperity. Read more about the Financial Literacy Programme in our ESG Report on page 51 .

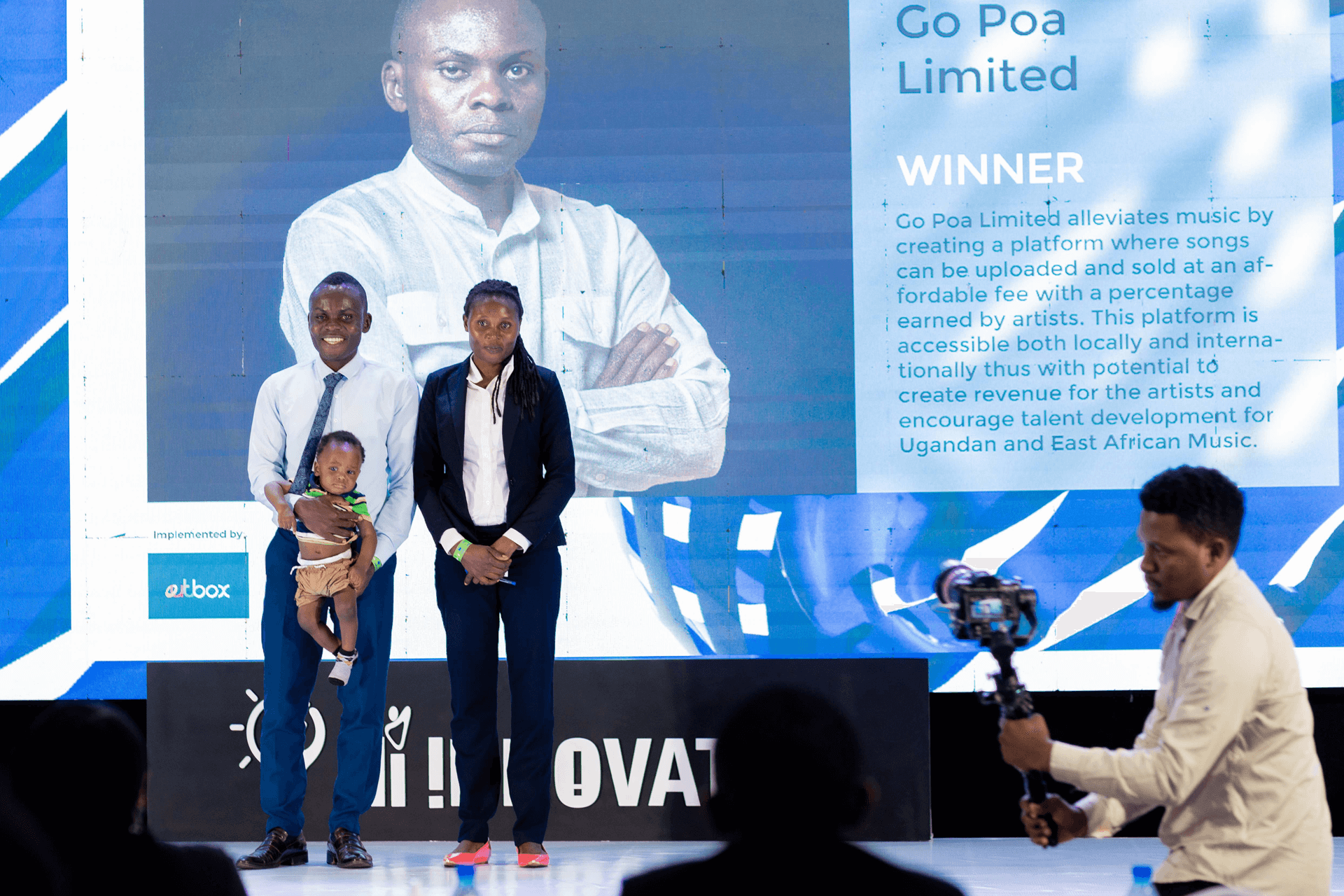

Hi-Innovator programme

This initiative is aimed at supporting the youth and small and medium sized businesses to sustainably grow through entrepreneurial education, funding, and technical support. The Fund is undertaking this initiative in partnership with the Master Card Foundation. A USD 10M five-year fund was created to provide seed funding to qualifying entrepreneurs.

During FY2022/23, a special cohort called the Hi-Innovator Women Accelerator Programme was introduced. It aims to help women entrepreneurs enhance their business skills, grow their businesses, and prepare them for future investor funding.

The programme intends to seed-fund 500 Small-and-Growing-Businesses (SGBs) by 2025. This will not only increase the Fund’s membership base but also contribute to economic growth through widening the tax base, creation of employment opportunities. Read more about the Hi-Innovator Programme in our ESG Report, page 58.

Internal innovation initiatives and programmes

The Fund’s innovation strategy looks to future-proof the business from disruption – which could emanate from changes in customer behaviour, regulation, and/or technology trends (among other things). In January 2022, the NSSF Amendment Bill was passed into law. It has necessitated a major change in the Fund’s business model – where the informal sector is now a major customer target market. Having anticipated these changes, the innovation portfolio benefited from two business concepts:

Yollo Save

Aims to make saving a painless process. The team behind Yollo Save want to test the hypothesis that “if saving was fun and effortless, more Ugandans would save and invest”. A proto-type was developed which enables one to “save-as-you-spend”, looking at spending at supermarket outlets as a test case. The evidence proved that Ugandans are willing to “penalise” poor spending habits with a savings penalty. The proto-type is currently being integrated into the Fund’s main offering to the voluntary sector – SMART LIFE. Smart Life is a life-style-oriented ecosystem of products and services targeting voluntary savings. It includes tenor-based saving and investment products, and insurance services. Yollo Save will essentially be one of the “smart ways” of replenishing one’s SMART LIFE digital saving wallet.

Agro-desk

With over 5 million farmers making up a big portion of Uganda’s 17million workforce, Agro-desk looks to link farmers with market opportunities via an end-to-end digital platform. With an assured market, farmers benefit from increased certainty on earnings, and are willing to set aside a small portion of their earnings as an opportunity cost for using the platform. As the sponsor of the digital platform, NSSF would benefit through increased membership and auto-savings via the digital platform. However, a few challenges were encountered, and these are under examination before proceeding with execution.

Black Swan and Trail Blazers

These two ideas have been merged into one concept to deliver unique and customised financial literacy coaching to informal sector workers while providing digital and physical platforms to connect them to customers, financial services, and markets.