OUR REPORT OVERVIEW

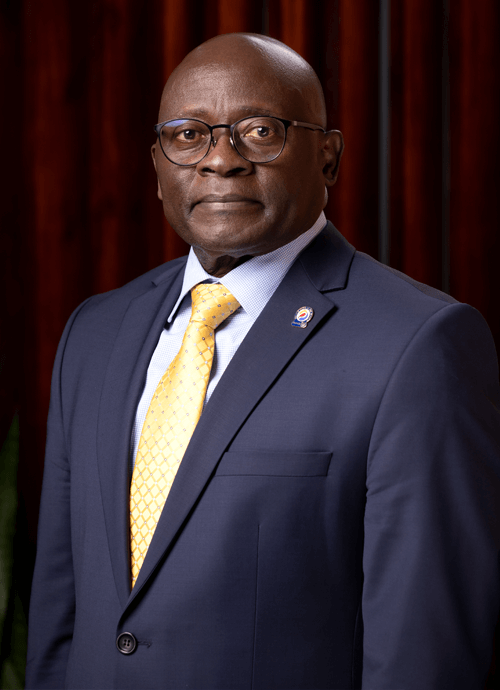

CHAIRMAN'S STATEMENT

Reflections on the past year

Looking back at the past year, the latter half has fortified the Fund's determination to maintain exceptional performance during challenging times. Our performance throughout the year has consistently exceeded the average, aligning with our strategic goals set for 2025. Noteworthy is our favourable compliance rating from the Regulator, signifying our commitment to maintaining compliance across all Fund levels, surpassing the norm. We have continued to foster strategic partnerships with entities from the public, private, and civil sectors, further solidifying our community presence and vision for inclusive prosperity.

Although our performance remains robust, a reshaping of our investment portfolio is imperative to create broad-based value within Uganda. A significant development this year was the Parliamentary inquiry into the Fund's operations. Overall, NSSF has been found to uphold the required professional standards, with no significant concerns raised by the anti-corruption coalition. The lessons learned from these investigations will be integrated into our processes to enhance member value.

As a Board, our top priority is to be transparent and rebuild trust among members, staff, external stakeholders, and the broader public following these events. I reassure members that their funds are secure and thriving.

Reflections on the past year

Looking back at the past year, the latter half has fortified the Fund's determination to maintain exceptional performance during challenging times. Our performance throughout the year has consistently exceeded the average, aligning with our strategic goals set for 2025. Noteworthy is our favourable compliance rating from the Regulator, signifying our commitment to maintaining compliance across all Fund levels, surpassing the norm. We have continued to foster strategic partnerships with entities from the public, private, and civil sectors, further solidifying our community presence and vision for inclusive prosperity.

Although our performance remains robust, a reshaping of our investment portfolio is imperative to create broad-based value within Uganda. A significant development this year was the Parliamentary inquiry into the Fund's operations. Overall, NSSF has been found to uphold the required professional standards, with no significant concerns raised by the anti-corruption coalition. The lessons learned from these investigations will be integrated into our processes to enhance member value.

As a Board, our top priority is to be transparent and rebuild trust among members, staff, external stakeholders, and the broader public following these events. I reassure members that their funds are secure and thriving.

The Fund’s momentum to strategy 2025

Advancing towards our Strategy 2025, which aims for 95% staff satisfaction, 1-day turnaround time, 95% customer satisfaction, and a 20 trillion Fund, it is commendable that our team remained driven in pursuit of these goals despite the challenges.

Management has consistently communicated these objectives, fostering a shared understanding among staff, and progress is meticulously monitored in line with the strategy, ensuring a focused approach.

I would like to invoke the Latin phrase " E pluribus unum," meaning "Out of many, one." This signifies our unity as a team, where the Fund's success hinges on each one of us.

Implementation of the NSSF Amendment Act

Regarding the implementation of the NSSF Amendment Act, FY 2021/22 saw the introduction of midterm access as a significant impact. Leveraging enhanced operational methods and technology, along with a strong branch network, the Fund has flourished while offering this benefit to eligible members.

While certain aspects of the amended Act are still in transition, a clear action plan has been devised. Equipped with the necessary talent and technology, we are poised to introduce innovative products to the public. Delays caused by the Parliament's release of NSSF regulations have impeded early implementation, but we are ready to proceed once these regulations are passed.

Outlook for the year ahead

As we look towards the next 12 months, there are several key aspects that we shall focus on:

Embracing technology to provide customised services and expand our reach

The Fund functions as a technology-driven entity and will continue to leverage technology to offer tailored services across all market segments. We intend to employ technology to both strengthen and widen our presence in Uganda and the surrounding region, extending into spaces occupied by SACCOs, investment clubs, and village saving groups.

Reshaping the investment portfolio for resilience and broadening our impact

Legal limitations presently restrict our investment structure, such as the inability to invest beyond East Africa. With the Africa Continental Free Trade Area emerging, NSSF aims to capitalise on this opportunity for increased value creation beyond the region. Exploring the agricultural sector value chains, rich with potential, is also part of our strategy. To move beyond conventional investments like fixed income, equities, and real estate, we are establishing an adaptable internal innovation hub at all Fund levels to facilitate this portfolio reshaping.

Strengthening partnerships with government and institutions to drive infrastructure development

Acknowledged as a crucial element within Uganda's stringent post-Covid-19 budget provisions, the Fund is perceived by the Government as instrumental. While traditional limitations restrict the Fund's investments to real estate, fixed income, and equities, there's growing recognition that our institution should actively support the government's agenda for infrastructure development and socio-economic recovery, aligning with Uganda's National Development plan.

Therefore, in the next year, we shall develop a robust multistakeholder engagement approach with both technical and institutional partners such as local governments and private sector organisations.

Scaling up sustainability efforts based on ESG principles

The Fund has made significant strides in promoting sustainability aligned with the (17) seventeen UN SDGs. This year, we took a step forward by releasing our inaugural ESG Report. This report showcases our initiatives including the staff wellness programme, financial literacy efforts, innovative landmarks like Pension Towers and the Lubowa Housing project, educational institution construction, and support for small businesses through the Hi-Innovator project, among others. We are in the process of formalising our ESG strategy and framework. Although a lot of work has been done, the accountability ecosystem for sustainability will continue to be scaled up.

Using digital and analytics for informed decision-making

The Fund has a large pool of data-driven knowledge from the market business environment and the legal and regulatory space. We are therefore embedding data and analytics into decision-making processes to make informed decisions that enable us to create further value for our members.

Sustaining legacy projects while creating innovative solutions

The Fund continues to preserve and grow legacy projects that have been successful while concurrently initiating new endeavours to adapt to the evolving landscape. This approach aims to provide innovative solutions to our members in response to changing circumstances.

Investment in human talent for future growth

I strongly believe that the Fund has the highest concentration of human capital, and we are committed to nurturing this talent as we strive to empower each individual to realise their "1+2" potential.

Let me illustrate the point above, consider an instance where an individual enters the Fund in the capacity of an accountant (representing their "1"). Over time, they should expect to undergo supplementary training, transitioning into roles such as a digital analyst or a sustainability specialist (shaping their "2"). This approach will foster the cultivation of well-rounded employees, aligned with the future demands of the Fund.

Strategy 2035

Looking ahead to Strategy 2035, we envision extending coverage to 5 million savers, leading to a 50 trillion Fund, fostering satisfaction among both members and the nation.

Conclusion and Appreciation

Amidst the uncertainties that clouded the past financial year, I take immense pride in our staff's unwavering unity, focus, and adaptability. Our collective strength was rooted in the understanding that truth faces no fear when challenged. Allow me to conclude with a passage from Sun Tzu's "The Art of War": "If you know the enemy and you know yourself, your victory will not stand in doubt; if you know Heaven and you know Earth, you may make your victory complete." This counsel underscores the importance of comprehending both internal and external factors. Recognising our strengths, weaknesses, resources, and limits is crucial for sound decision-making. Equally vital is understanding the broader context, encompassing political, social, and cultural dynamics, the physical environment, and the influence of time and space.

Our success within the Fund is notable, and I extend my congratulations to all. However, it is time to extend our gaze beyond and collaborate with external stakeholders to fulfil our purpose of improving lives for shared and inclusive prosperity. Gratitude goes to the Fund supervisors, and my fellow Board members for their guidance and support. In addition, and on behalf of the Board of Directors, I express deep appreciation to the Fund's employees and the Executive Team for their combined efforts that contributed to the Fund's achievements.

To our valued members, you remain at the heart of our endeavours and we are committed to being your social security provider of choice.

Peter Kimbowa,

Chairman Board of Directors