OUR PERFORMANCE

CFO'S FINANCIAL REVIEW

FY 2022/23 Key Performance Highlights

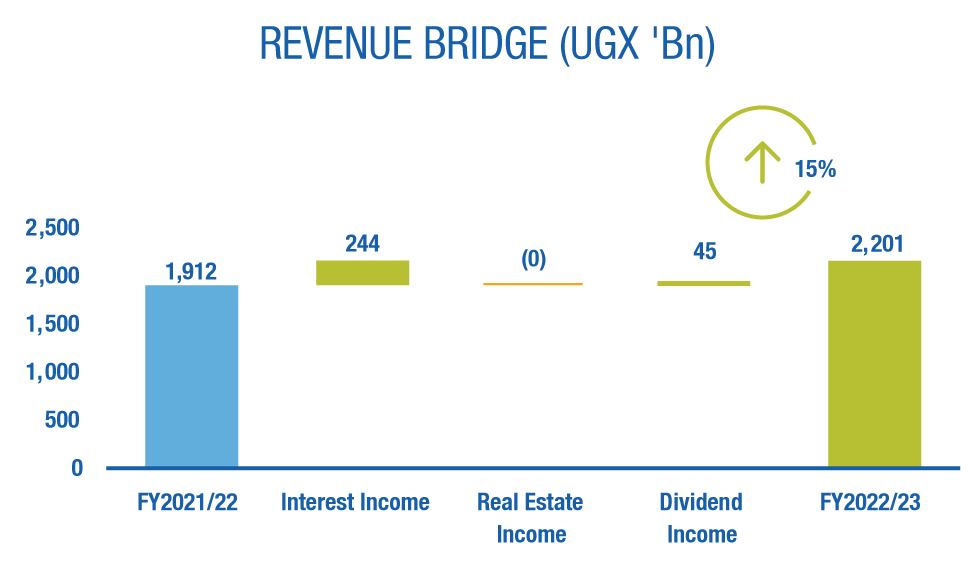

Revenue

As a result, total realised revenue grew by 15% from UGX 1.912Bn to UGX 2.201Bn driven by the growth in Fixed Income and Dividend Income.

Operating Costs

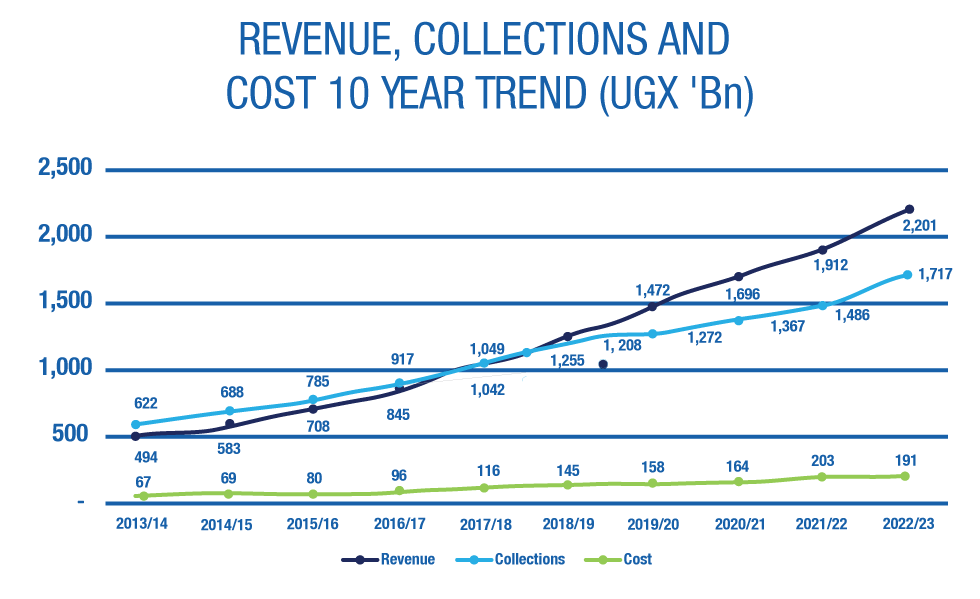

Annual operating costs reduced by 6% from UGX 203Bn in FY 2021/22 to UGX 191Bn in FY 2022/23, and 14% below the budget of UGX 221Bn. This due to the Fund’s cost saving mechanisms and the reversal of the unutilised provisions from prior periods.

Annual cost to income (Total Income) ratio stood at 16.4% in FY 2022/23, from 11.4% in FY 2021/22 due to the reduction in total income because of the significant unrealised exchange loss. The expense ratio reduced to 1.03% in FY 2022/23 from 1.18% in FY 2021/22. This was lower than the target of 1.16%.

Whereas revenue and collections have grown by a compound annual growth rate (CAGR) of 19% and 12% respectively, costs have only grown by a CAGR 10% over a 10-year period (FY 2012/13-FY 2022/23). Revenue has posted significant growth over the historical period, and it continually surpassed collections from FY 2018/19 onwards. In FY 2022/23, revenue was higher than collections by 28% and this gap continues to grow.

Interest Credited to Members

The Fund declared a return to members of 10% in the FY 2022/23 resulting into UGX 1.584Bn compared to 9.65% in the FY 2021/22 which resulted in UGX 1.380Bn.

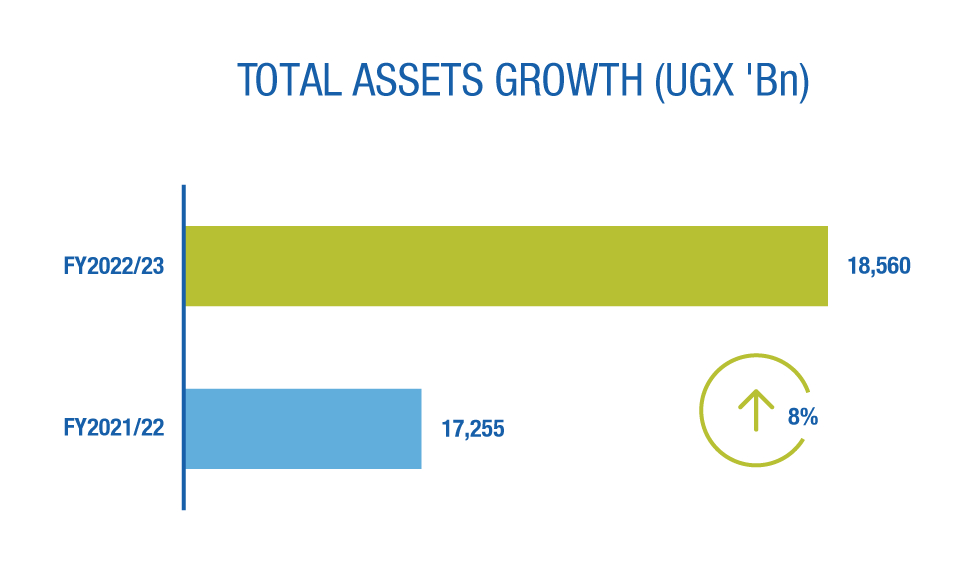

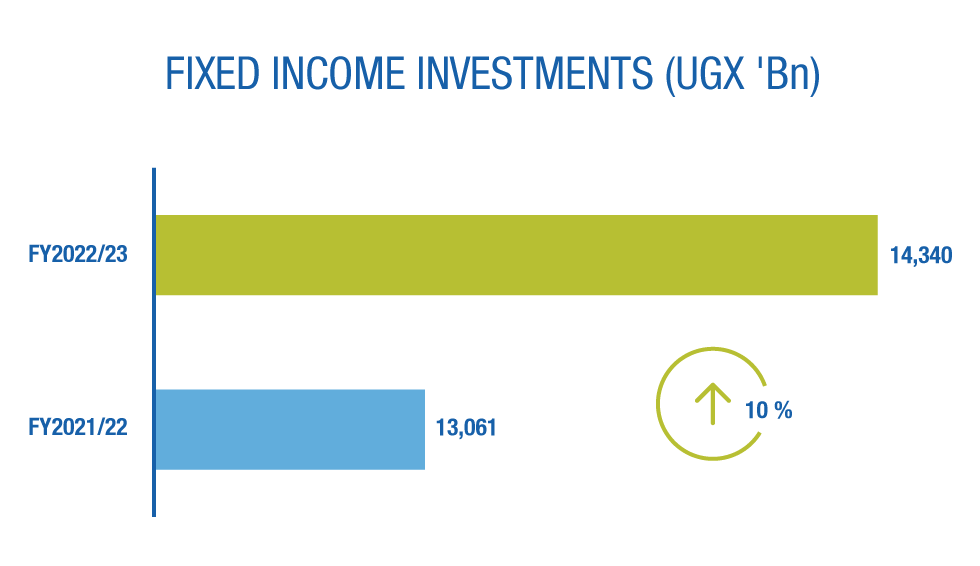

Financial Position

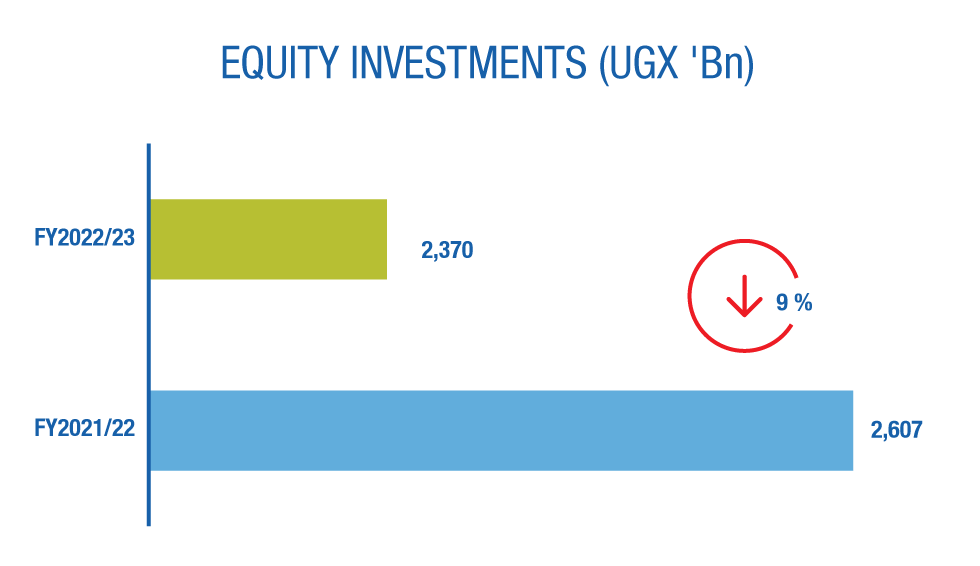

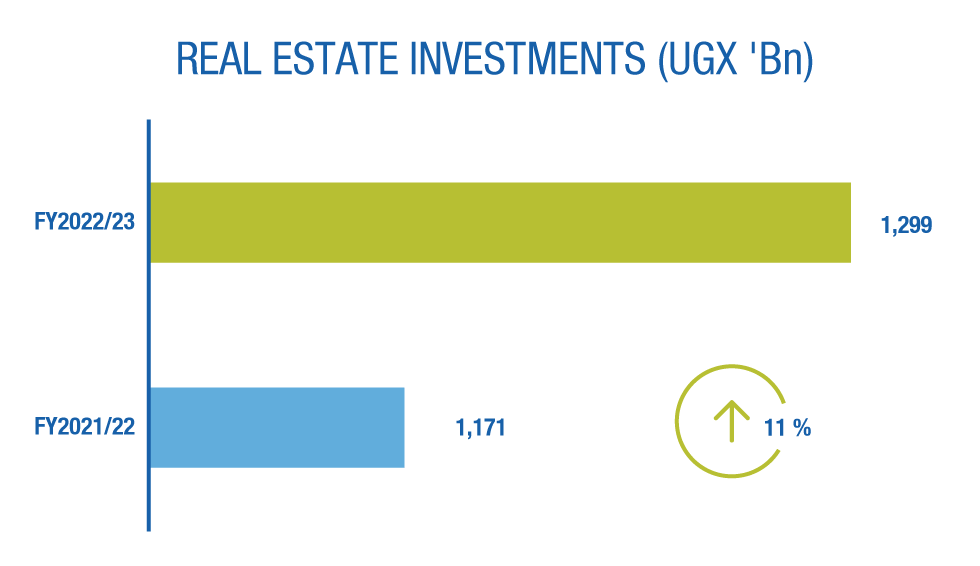

The Fund invests in 3 asset classes: Fixed Income Securities, Equity Securities and Real Estate.

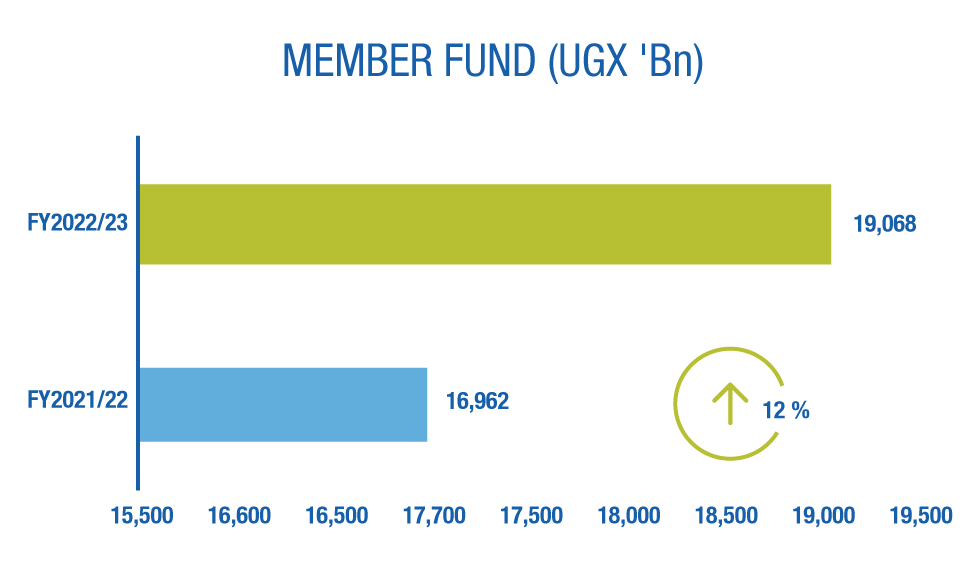

Accumulated Member Fund

Member Fund grew by 12% to UGX 19.068Bn (FY 2021/22: UGX 16.962Bn) driven by contribution collections of UGX 1.717Bn and interest credited to members of UGX 1.584Bn net of total benefits paid of UGX 1,199Bn.

Taxation

The Tax Appeals Tribunal ruled against NSSF in March 2020 in a significant income tax matter that has been under dispute since 2013. NSSF appealed to the High Court and on 2 November 2020, the High Court delivered judgment in favour of the National Social Security Fund.

Court ruled that the interest paid by the Fund to its members is a deductible expense for income tax purposes and that the Fund was not liable to pay the tax assessed. URA was dissatisfied with the decision of the High Court and subsequently filed an application for leave to appeal and an application for stay of execution.

On 16 August 2022, Court dismissed the application for leave to appeal with costs citing that it was filed outside the statutory period envisioned under Rule 40(1) of the Judicature Court of Appeal Rules. The Court further ruled that a delay of 92 days was unreasonable and there was no proper reason for the delay.

URA has since appealed this decision and is seeking permission to appeal from the Supreme Court. However, NSSF is engaging URA to recover the 30% deposit amounting to UGX 25Bn plus interest and costs in line with the current ruling.

Cashflow Analysis

The closing cash and bank balances stood at UGX 190.7Bn in FY 2022/23 compared to UGX 72.8Bn in FY 2021/22.

Net cash generated from financing activities amounted to UGX 531.4Bn. Net cashflows used in investing activities was UGX 304.6Bn whereas net cashflows used in operations was (UGX 108.9Bn).

This is a clear indicator of the Fund’s ability to generate enough cash for all routine operations, financing and investing activities.

Update on Accounting Standards

Due to the constantly evolving global business environment, the International Accounting Standards Board (IASB) that develops and approves International Financial Reporting Standards (IFRSs) under the oversight of the IFRS Foundation issues new standards and amendments to the existing ones.Several amendments to existing standards became effective during the year. However, these had little/no impact on the Fund’s financial statements.

These included the following:

There are new and revised International Financial Reporting Standards issued but not yet effective.

These included the following:

We highlight further the significant accounting policies and how these affect the Fund in Note 3 of the financial statements.

Economic Outlook over the Short, Medium and Long Term

The trajectory of global economic recovery and growth remains uncertain because of the prolonged adverse effects of the Russia-Ukraine conflict. The increase in central bank rates aimed at mitigating inflation continues to impact economic activity. Inflation, however, is projected to gradually recede as the war induced peaks normalise.

From a regional perspective, recovery of the Kenya shillings hinges on several factors including improved tourism, end of the drought, sustained political stability, reduction in oil prices among other factors. These would then lead to increased foreign exchange inflows into the country. However, this portrays a very optimistic outlook as current conditions cast doubt on the likelihood of this happening soon.

Uganda’s economic prospects are projected to improve with GDP forecasted to grow at 6.5% in 2023 and 6.7% in 2024 according to the African Development Bank. This assumes that global growth slowdown will be short lived. BOU’s contractionary monetary policy stance since June 2022 to date, along with the declining global inflation is expected to reduce inflation further in the coming months. The relatively stable shilling has also helped accelerate the disinflation process.

Despite the improvement in the near-term inflation outlook, BOU’s current inflation projections remain susceptible to eminent risks like imported inflation and tighter global financial conditions which could weaken the shillings exchange rate. This could exert pressure on consumer prices.

The positive economic outlook provides an enabling operating landscape that will not only be critical to achieving our 2025 vision but also envisioning NSSF of the next decade. Our ambitious goals for the next decade include enhancing our coverage to 50% which currently stands at less than 10%, attaining an asset size of UGX 50Trillion (Currently UGX 18Trillion) and achieving staff and stakeholder engagement scores of 95%.

As a Finance Function, we remain committed to driving Fund-wide strategic and operational excellence by providing data driven decision support, predictive analytics, adoption of relevant emerging technologies for continuous process improvements and talent nurturing. These continuous efforts are critical pillars that strengthen our ability to keep adapting in the ever-changing operational landscape, and ultimately guiding the Fund towards lasting success.

Appreciation

My sincere appreciation to the Board and the Executive Management Team for their great support and co-operation rendered during the year. Special thanks is extended to Team Finance for their continuous commitment to future readiness through excellence and innovation and, lastly to all NSSF employees for their firm commitment to ensuring that the Fund achieves its purpose of Making Lives Better.

Stevens Mwanje,

Chief Financial Officer