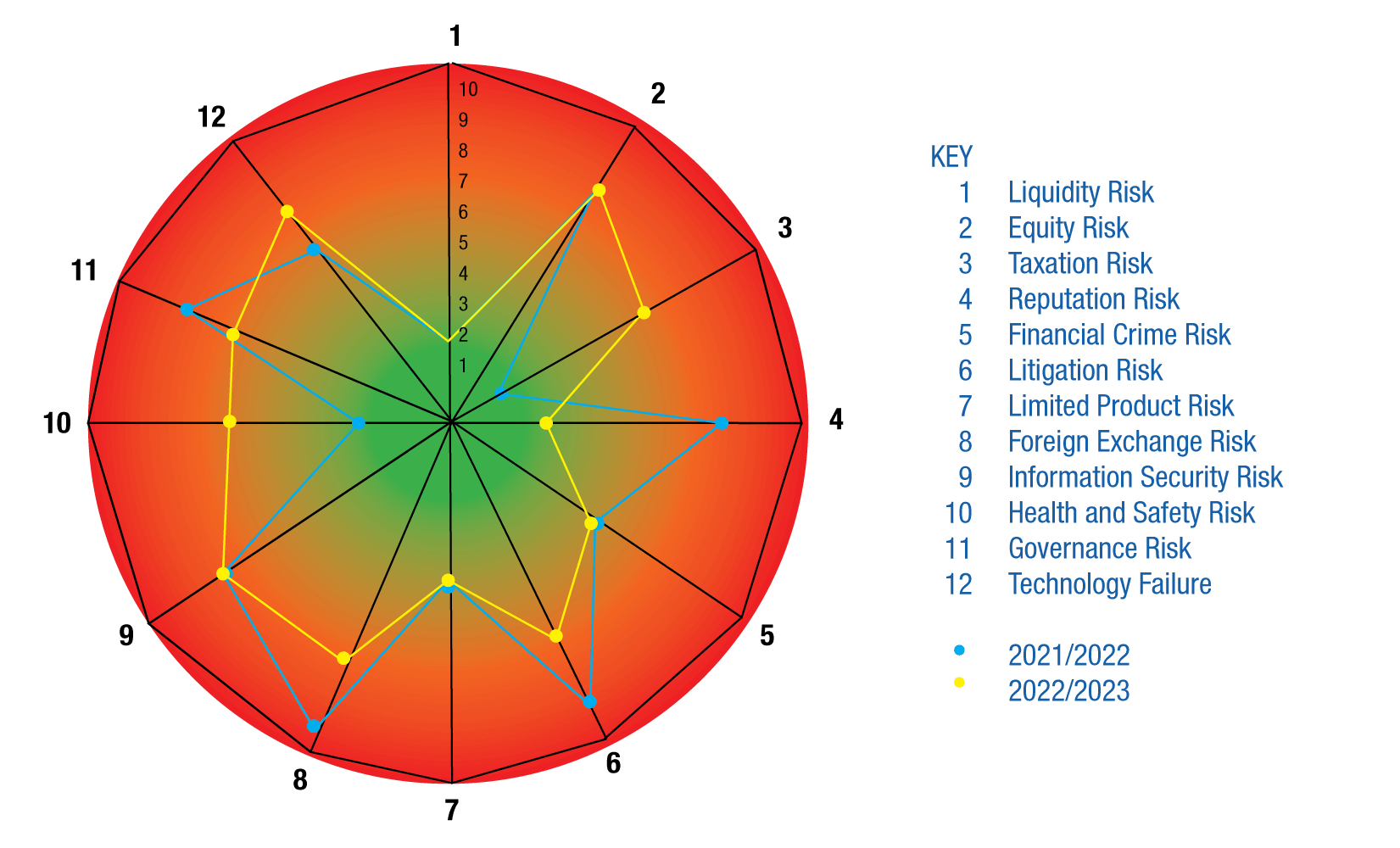

Key risks in 2022/23, treatment, opportunities, trend,

and outlook

Risks driven by local factors

11. Health/safety and operational risk

2021/22

2022/23

Trend

Description of risk and the Fund’s response

As the country was beginning to recover from Covid-19, there was an Ebola outbreak during Q2 of FY22/23 that spread to many parts of the country.

In response, the Fund conducted online business in areas with high Ebola cases and created an emergency health response strategy to handle any potential infections, which protected the staff against contracting Ebola.

Opportunities

The outbreak of pandemics has enabled the Fund to test the resilience of its emergency strategies.

Outlook

The timing of pandemics is unpredictable. However, NSSF is now more prepared to deal with any future disease outbreak, given that our emergency strategies have been tested and proven to be effective.

Capital Impacted

Stakeholders Impacted

Material Matters

Strategic Objectives Impacted

12. Liquidity risk

2021/22

2022/23

Trend

Description of risk and the Fund’s response

Liquidity risk was rated low, despite an increase in benefits payout by UGX 10Bn (0.84%) over and above the previous year. The strong liquidity position was attributed to a significant increase in contribution collection of UGX 230Bn (15.5%) over and above the previous year.

The Fund will continue to undertake regular cash flow forecasts and address any potential shortfalls in the liquidity requirement while undertaking investments to provide a reasonable return to members.

Opportunities

The payouts have increased member confidence and trust in the Fund, creating an opportunity for recruitment of new members, especially in the voluntary space.

Outlook

There is likely to be a slight liquidity squeeze due to major cash outflows after the declaration of interest to members.

However, cash flow forecasts will be undertaken to identify potential cash shortfalls and address it proactively.

.

Capital Impacted

Stakeholders Impacted

Material Matters

Strategic Objectives Impacted

Heatmap (Severity and trend): 2022-23

Broad strategy for addressing emerging risks

NSSF is cognisant of the fact that new risks emerge from time to time and has taken deliberate steps to ensure that it is able to respond to the risks appropriately, by putting in place the following strategies in areas of human resources, processes, systems, stakeholder management and governance.

Human resource competencies

Human resources are crucial for identifying, assessing, and mitigating emerging risks. The Fund, therefore, undertakes professional development of its staff to ensure they all have the necessary risk management competencies.

Robust processes

The design and operation of business processes are key determinants of efficient service delivery and increased productivity. The Fund regularly reviews and automates its processes to ensure that they are seamless, convenient, and user-friendly. Nearly all customer services are accessible online, offering convenience and flexibility to our members.

Resilient systems

To enhance the resilience of its systems, the Fund:

Stakeholder management

The Fund has many categories of stakeholders, each category with varying interests, which in most cases are sources of risk to the Fund. To manage this risk, the Fund developed and implemented a comprehensive stakeholder engagement strategy. The strategy identifies the impact and influence of stakeholders to the Fund, and how the Fund should respond to the different stakeholders.

Environmental, Social and Governance (ESG) factors

The Fund is cognisant of the ESG factors that can significantly impact its finances, operations, and reputation. The issue of climate change for example, is taking centre stage in the global arena. Extreme weather conditions can cause food insecurity, heat waves, flooding, etc, which can affect employers’ ability to meet their NSSF obligations.

Corporate activities can have significant negative impact on the community. In carrying out its business activities, the Fund ensures that potential negative effects on the community, as well as the environment, are minimised. For instance, the Fund undertakes environmental impact assessments before embarking on real estate development.

The Fund has established appropriate governance structures, including a board of directors, whose majority members are non-executive directors. The Fund is a member of the Governance council of the Institute of Corporate Governance and has participated in the corporate governance surveys conducted by the Institute, for which it has received a number of accolades.

To embed ESG principles in the organisational culture, the Fund is in a process of developing an ESG policy and framework.