OUR PERFORMANCE

CIO'S BUSINESS REVIEW

Investment beliefs

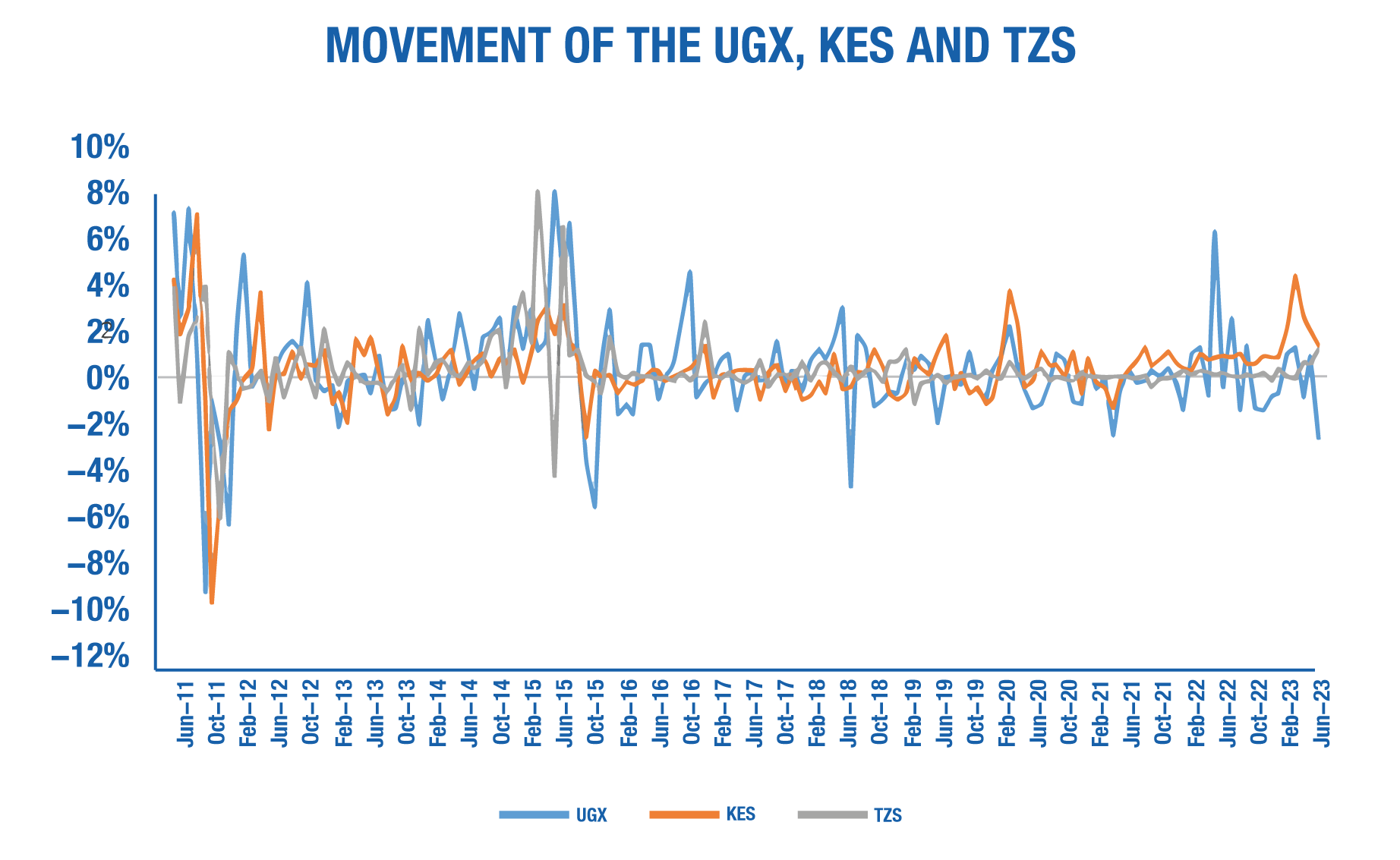

Figure 5: Movement of the UGX, KES and TZS Against the USD

Source: Internal Computations

Foreign currency and hedging

Changes in foreign exchange rates on our non-Uganda Shillings investments have a substantial impact on short-term investment performance expressed in Uganda Shillings.

The exchange rate loss in the fiscal year was UGX 1.05Tn compared to UGX 13.63 Bn last year. Some investors manage this risk with currency hedging, which reduces the shorter-term impact of foreign exchange rate changes on their returns.

From Figure 5, we see that over the period June 2011 to June 2023, the timing of large moves varied across the three currencies, with the UGX most vulnerable to wild swings reflecting the openness and narrowness of Uganda’s economy which exposes the currency to global headwinds.

On the other hand, the KES and TZS have seen a stable yet steady depreciation except in 2011, 2015, 2020 and 2023 when they could not resist wild swings.

Movements in the UGX tend to be more correlated with the KES (a correlation of about 32%) reflecting the closer trading relationship between the two countries. The correlation between the UGX and TZS is low at 3.2% rendering Tanzanian assets as diversifying opportunities for the Fund’s portfolio. The KES and TZS have the highest correlation of 38%. Indeed, both currencies often move in the same direction against the UGX. This explains why periods of FX gains or losses from Kenya tend to be associated with gains or losses in Tanzania.

Hedging carries a significant execution cost, however, and requires setting aside cash or at times generating it quickly to meet currency hedging contract obligations.

The Fund’s investment strategy sees currency risk as a potential source of incremental return.

We believe that extensive hedging of foreign investments is not appropriate for the Fund for the following reasons:

In-house asset management

During this fiscal year, we conducted an asset allocation and investment strategy review, focusing on our comparative advantages, and eliminating costly fees.

This reinforces our stance on in-house asset management. Keeping the bulk of the assets under internal management saves the Fund over UGX 30Bn (that could be even more) a year in fees. Internal management is less than a third of that cost.

We believe that the Fund’s respected brand allows us to attract, motivate and retain high-caliber investment professionals and operational specialists. It also helps differentiate the organisation in hotly contested markets for select investments.

Our investment programme is designed to capture regional growth while also demonstrating resilience during periods of market uncertainty. Our team of professionals corroborate information from across the region to apply their deep expertise and local knowledge to source investment opportunities, engage with world-class partners and build value in our existing assets.

Real estate and alternatives

Not many schemes have real estate and alternative investments as an asset class because of their inherent risks. We believe that over the years, despite legacy issues, we have built the capacity to turn this into a distinct opportunity and advantage for the Fund going forward. Real estate offers diversification opportunities for the Fund. Its impact and effectiveness are most seen when the equity markets are volatile, like what we saw last year—even a single digit positive return is better than a negative return. Our goal is to make this return a double digit going forward.

Long-term investment approach

We believe in a long-term investment approach. The investment team has the scale to engage in almost every capital market and investment opportunity in the East African region. The unique characteristics of the Fund, together with the circumstances that we can benefit from or control, drive our investment strategy. The Fund manages an investment portfolio to meet its current and future obligations over the long term, including paying benefits in a timely fashion, generating real long-term annualised returns, and minimising the likelihood of a substantial, sustained drawdown of its assets. Consequently, we can withstand short-term downturns to create value over the long run.

The progress made since the last fiscal year is summarised in Table 3 below:

Table 3: The progress made since the 2022 Investment Review

| No. | Item | Progress |

| A | Reducing the allocation to fixed income to 75% of the investment portfolio. The minimum allocation is 70% while the maximum is 82.5%. | This target remains largely a work in progress as most of the opportunities to absorb the kind of liquidity of a scheme of our size tend to exist in the fixed-income asset class. Nevertheless, we managed to keep the allocation flat at 78.48%. |

| B | Increasing the allocation to equities to 17.5% of the investment portfolio. This will include listed and private equity. The minimum allocation is 12.5% while the maximum is 20%. | This target weight is still a work-in progress. In the fiscal year, allocation to equities remained flat at 12.51% on account of fall in equities largely on NSE. |

| C | Maintaining the allocation to real estate at 7.5% of the investment portfolio. This will include investing in build and sell projects, commercial and mixed-use properties, and land banking. The minimum allocation is 5% while the maximum is 10%. | This was largely achieved. The Mbuya Citadel is now fully sold. The completion of Lubowa and progress at Pension Towers did not increase the allocation out of the range. It closed at 9%. |

| D | Unlocking the value of real estate land by producing concepts to have it developed. | Construction works are ongoing in Temangalo and Mbale. Progress was also made on the Pension Towers and Lubowa projects. There were delays in acquiring land in Gulu and completing the procurement of a design and build contractor for Yusuf Lule Road. |

| E | Diversifying by country (within the investment universe), asset class, sector, currency, and many other risk factors. | This continues to be a work-in progress. We deployed UGX 65Bn in equities. This was informed by the liquidity available. We were also affected by the disruptions in Fund activity in the last half of the fiscal year. |

| F | Exploring new asset classes that improve the risk-return profile of the Fund and working with the regulator to have them cleared. | We continue to engage the regulator and other partners on securities lending and launching several products. |

The plans for the year ahead: the macroeconomic and market environment

On average, we expect the economies of the countries we invest in to register an average growth of 5.5% with inflation within the targeted range of 5% to 7%. We expect yields to remain elevated in Kenya and to gradually rise in Uganda and Tanzania in the short to medium term. In this current high-yield and expected growth environment, we will strive to execute on our strategy of achieving a double-digit return target. These challenging times require innovation and an understanding of our structural advantages.

Outlook

Our investment management strategy focuses on achieving the following goals:

We will continue to employ a total portfolio investment framework designed to optimally achieve the above dual goals. We are committed to the Fund’s purpose and mission of achieving competitive returns that, over the long run, will empower members to achieve economic security and believe in saving as a way of life. We are also committed to the success and sustainability of our programmes.

Our mission remains the same: manage the Fund`s investment portfolio in a cost-effective, transparent, and risk-aware manner to generate returns that create value for members. We are confident that the combination of skilled and professional investment staff and a well-considered investment strategy, will enable the Fund to deliver robust performance over the long term.

Gerald Paul Kasaato, CFA

CHIEF INVESTMENT OFFICER