OUR PERFORMANCE

CIO'S BUSINESS REVIEW

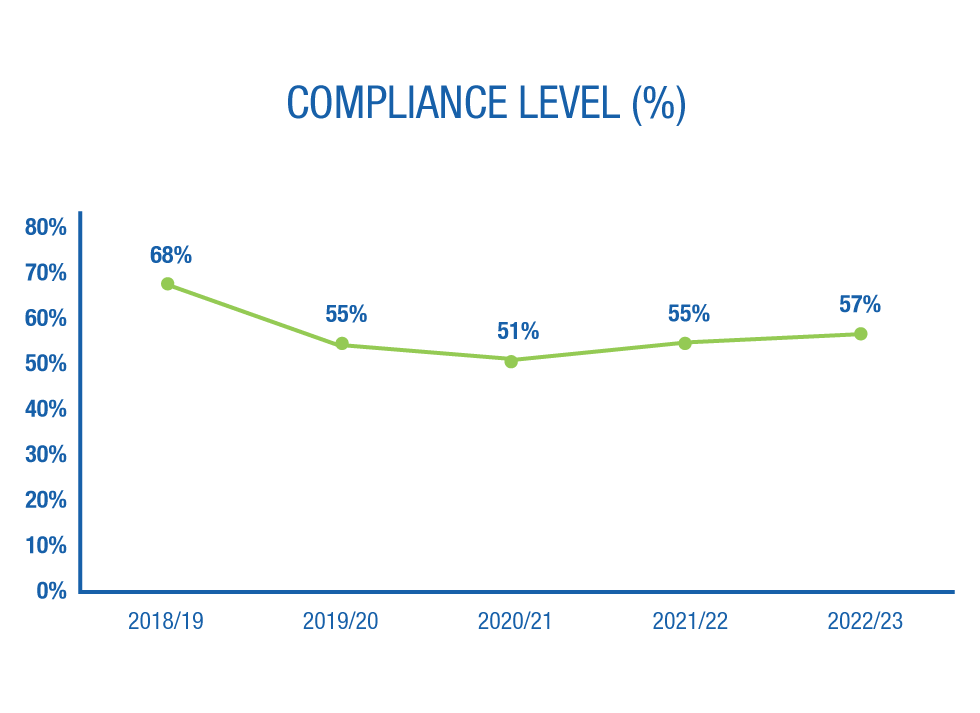

Figure 4: The Fund’s compliance trend in the last four fiscal years

Source: Internal

Slow recovery in Compliance and Collections

The impact of the lockdown to combat the spread of Covid-19 weighed heavily on compliance rates.

However, as depicted in Figure 4 below, we saw compliance rates recover in the fiscal year (from the low levels of 2020/2021).

Delays in collections or non-compliance, results in the investment programme being adversely affected.

In partnership with the Ministry of Gender, Labour, and Social Development, there is a drive to train and equip labour inspectors to ensure compliance with the existing labour laws.

Impact of geopolitical tensions and Covid-19 on real estate projects and investments as a whole

Africa is not immune to the crisis of Russia and Ukraine as these two countries are major producers of various key commodities such as oil, gas, wheat, and corn. This coupled with the dry weather conditions in the fiscal year, exacerbated inflation pressures in the region. Therefore, the imposition of sanctions to Russia and the consequent disruption of the supply chains led to soaring prices of commodities. The resulting inflationary pressures caused central banks to tighten monetary policy.

Moreover, we saw the escalation in construction material prices because of disruptions in supply chains and rising fuel costs also affected projects. To this end, the progress on construction works slowed down as contractors requested for extensions of time. We continue to navigate the bumpy path of balancing compliance while pragmatically solving the issues on the various projects to improve their progress.

Opportunities

Despite the downside effects and trade-offs, we took advantage of several opportunities.

Diversification opportunities in the regional equity markets

Diversification of the portfolio continues to be a continuous journey. The result is that over the years, we have managed to build resilience in the overall portfolio performance, irrespective of the times—the year ended 30 June 2023, is another testimony to that. The equity markets volatility continued throughout the end of the fiscal year with some counters experiencing fluctuations of more than 20%. We took advantage of the diversification opportunities in the market albeit with the constraint of liquidity because of significant payouts to fund benefits. The Nairobi Stock Exchange registered another consecutive year of net foreign outflows. This was driven by the overall negative market sentiment on account of heightened macro risks which saw foreign investors exit the market.

In Uganda, the market received the news in December 2022 that Government will not renew the concession of Umeme beyond 2025. Since the announcement, the market sentiment has not been negative. Another significant event was the Bank of Baroda (BOBU) rights 5-for-1 rights issue which saw the company price decline to a price of UGX 16 a share from UGX 80. The rights issue was triggered by a need to raise funds to comply with the increased capital requirements by Bank of Uganda. In Kenya, Safaricom began operations in Ethiopia. The results of Ethiopia affected its performance for the year which together with the macro issues of Kenya, and the performance of the Kenya Shilling, compounded its underwhelming share price performance.

Sustainability of the Fund’s Investments, Climate Change, and Impact

When an organisation implements socially responsible initiatives, the overarching aim is to contribute to sustainable development. Responsible investment is not only an integral part of the Fund’s investment thesis, but also part of sustainable development. We aim to identify long-term investment opportunities to reduce the Fund’s exposure to unacceptable risks. Climate change is a major risk and mitigating it is the responsibility of all. We look at companies that enable environmentally friendly economic activity more favourably. Through our active engagement model, we can directly engage with our portfolio companies on a wide range of material ESG-related considerations to enhance their long-term value to the Fund. We align these efforts to the value drivers of our portfolio companies, tailoring our approach of assessing and evaluating the issues that are most material to the companies’ long-term value creation and preservation. There are also companies we may choose not to invest in for sustainability or ethical reasons, for example, tobacco companies. On the other hand, we see merit in investing in companies with solutions that enable more environmentally friendly economic activity and sustainability.

Most of the blue-chip companies that the Fund has invested in have initiatives for inclusive prosperity, in addition to being chosen on account of providing a good return to members. For example, the Fund’s investments in the financial and telecom services industry actively support the development of small, medium, and micro-enterprises (SMMEs) and entrepreneurship. This includes investments such as; Safaricom, MTN Uganda, Vodacom Tanzania, Stanbic Bank, Equity Bank, KCB Bank, Trade Development Bank, CRDB Bank, Bank of Kigali, NMB Bank, to mention, but some. Inclusivity is a key screening parameter the Fund considers when investing in companies. By investing in some of the companies mentioned, the Fund has indirectly taken advantage of the fintech innovations which have broken barriers by providing financial services to unbanked populations in the region thereby increasing financial inclusion to people living in rural areas.

Our top five (5) equity holdings depicted in Table 2 below constitute 47.03% of the equity portfolio and are strong on sustainability through foundations focusing on themes like; economic empowerment, education, health, energy and the environment, food and agriculture, social protection, to mention but some. When we track all companies in the equity portfolio that are strong on sustainability, they constitute about 77.50% of the equity portfolio.

Table 2: Top Equity Holdings and Sustainability in the portfolio

| No. | Counter | Amount (UGX 000) | % |

| 1 | MTN | 336,600,000 | 14.43% |

| 2 | Tanzania Breweries Limited | 213,391,443 | 9.15% |

| 3 | Trade Development Bank | 189,162,568 | 8.11% |

| 4 | Safaricom Limited | 184,250,266 | 7.90% |

| 5 | Equity Bank Holdings Plc | 173,374,834 | 7.43% |

| 6 | Cooperative Rural Development Bank | 141,733,471 | 6.08% |

| 7 | Kenya Commercial Bank | 131,674,397 | 5.65% |

| 8 | National Microfinance Bank (NMB) | 124,998,120 | 5.36% |

| 9 | East African Breweries Limited (EABL) | 109,633,677 | 4.70% |

| 10 | Umeme Limited | 89,695,482 | 3.85% |

| 11 | Tanzania Portland Cement (Twiga) | 58,330,000 | 2.50% |

| 12 | Stanbic Bank Uganda Limited | 54,684,148 | 2.34% |

| - | Total | 1,807,528,406 | 77.50% |

Source: Internal

Although the Fund’s 2 million Euro investment in the Yield Fund is less than 1% of the total equity portfolio, the impact created is remarkable. The impact objective of the Yield Fund when set up in 2017 was a total investment of 18 million Euros or UGX 73 billion to provide support to around 15 Small and Medium Agribusinesses (SMAs) on a rolling basis over five years, selected through a rigorous nationwide identification process. Pearl Capital Partners (PCP) is the fund manager for the Yield Fund. PCP concluded the investment period in January 2023 with investments made in 15 Agricultural SMAs throughout Uganda. The 15 Fund investments are as summarized below:

SESACO Limited

This is a company that adds value to Soya bean. It is a food processing company. Some of the cereals are processed into beverages while others are milled and blended for nutritious foods.

Central Coffee Farmers Association (CECOFA)

CECOFA is a ‘farmer owned‘ organisation that brings together coffee farmers from the Central region (Wakiso, Masaka, Luwero and Bukuya, Kibale, Mpigi, Bukuga, Mubende), helping them improve their farming practices, access the international market, and receive free technical training and support in coffee farming.

Pristine Foods Limited

The company focuses on the production of extended shelf life for egg products with its core line of business being the manufacturing and sale of liquid, frozen, and powdered egg products.

Raintree Farms Limited

Raintree Farms is a company specialising in the value-added processing of Moringa Oleifera crops

Chemiphar (U) LTD

Chemiphar is a lab that tests the quality agro products/inputs ranging from foods and beverages, pharmaceuticals, cosmetics, fertilizers, animal feeds, etc.

Clarke Farm LTD

Clarke Farm is a 1,500-acre farm located in Kata bale, Kyarusozi Kyenjojo district in Uganda dealing in coffee production and processing.

NASECO (1996) Limited

NASECO is a private Ugandan seed company that started the production of improved seed production in 1996 and is currently one of the leading innovators and producers of seeds in Uganda and the great lakes region.

Sausage King 3000 Limited

Sausage King is in the business of selling fresh and processed beef products to all income groups in Uganda.

Sekajja Agro Farms Limited

Sekajja Agro Farms Limited is involved in poultry farming and related business.

AMFRI Farms Limited

AMFRI farms limited engages in the production and processing of certified organic and bio dynamic demeter fruits, vegetables, herbs, cereals, and spices for export for almost two decades.

Pura Agri Tech limited

Pura Agri Tech is located in Nakasongola District and engages in cassava processing and value addition.

Enimiro Uganda

Enimiro engages in coffee and vanilla farming and dried fruit production.

KAMP Group Limited

KAMP Group Limited operates an animal feeds milling plant situated in Anaka town, Nwoya district, and has a distribution centre in Kisaasi, Kyanja in Kampala district. It specifically produces broiler feeds (starter, grower, and finisher); layer feeds (starter, grower, and finisher); pig feeds; goat feeds; rabbit feeds; and cattle feeds.

Newman Foods Limited

Newman Foods Limited started out in fresh produce export, expanded into processing chili sauces, and eventually ventured into the snacks business and through this business got to interact with farmers and suppliers. Examples of the fresh produce exported by Newman Foods Ltd include; garden eggs, hot pepper, ash plantain, pumpkins, matooke, peanuts, red coco yam, stem yam, green chilli, kisubi tea, onions, avocado, sugarcanes, coco yam, sweet potatoes, mangoes, ginger, yellow beans.

Quality Milk Dairies Ltd

Quality Milk Dairies Ltd engages in diary production and has been in business for more than 18 years.

The impact proposition of the Yield Fund is based on generating an Economic Internal Rate of Return (EIRR), being the economic benefit derived because of the investment of at least 30% and is creating a minimum of 3,000 new jobs through the investee companies. The investee companies comply with acceptable ESG standards.

Our quest for sustainability also extends to real estate projects. The Fund’s projects have employed over 3,000 Ugandans at the different sites with even more indirect jobs created. But most importantly, we have made a deliberate effort to incorporate sustainability in the master planning and designing of projects. The value chain of real estate investments is big to the extent that every shilling invested has a multiplier effect of 12 to 15 times. The sustainability frontier is extended to green building practices. The pension towers project is on course to getting the Green Building Certification—the project is expected to be completed in 2024. The Solana project at Lubowa won an international Green Building Award, from BCA Green Mark Awards. We are also adopting green building practices at the Temangalo project.

Moreover, we aim to reduce energy costs by about 10% in the next two years using automatic lighting systems, energy-efficient fittings/appliances, and prepaid meters on the properties we manage like; Workers House, Social Security House, Jinja and Mbarara City Buildings.